Defining Trends for Bitcoin in 2025

Let's talk about all the bullish (and less bullish) catalysts for Bitcoin in 2025

Ein grosses Dankeschön an alle unsere Leser, die uns über die letzten Jahre begleitet und so tatkräftig unterstützt haben. Ihr seid der Grund, warum wir immer weitermachen!

2025 starten wir mit einer neuen Ausrichtung: Less Noise, More Signal. Der Fokus liegt künftig auf englischen Inhalten, um ein breiteres Publikum zu erreichen. Neben unserem wöchentlichen Podcast wird es einmal im Monat einen Newsletter geben.

Wir hoffen natürlich, dass ihr uns treu bleibt und unsere Inhalte auch in englischer Sprache weiterverfolgt. Euer Support bedeutet uns die Welt. Lets goo and keep growing together!

Thank you for sharing our newsletter with your colleagues and friends💪🏻🙏🏻

Let's gooo 🎢 What you can expect today:

Knowledge level : 🟢 Beginner | 🟡 Advanced | 🔵 Expert

Everything at a glance 🟢

Podcast episode “Less Noise More Signal”🟡

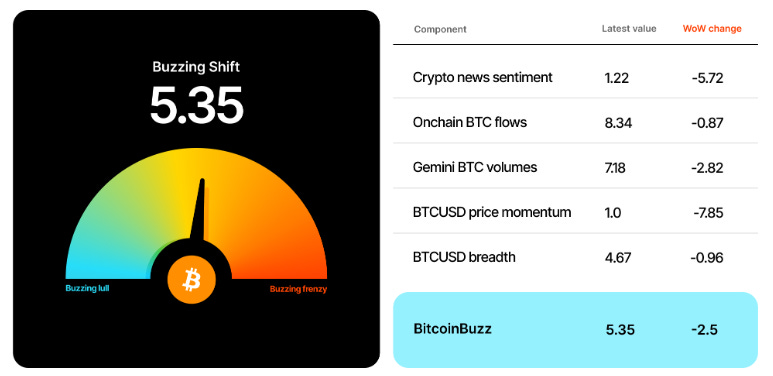

Market Update: Our regular overview give us now 🟡

Meme Section 🟢

Insight DeFi auf Social Media: LinkedIn / Instagram / Twitter / YouTube / Telegram

🟢 Everything at a glance

written by Pascal Hügli

🌐 Total Crypto Market Cap: $3.52 trillion (20.14%)

🌊 Digital Asset Fund Flows: +$48 million

💰 Bitcoin Price: $102,142.83 (12.42%)

🚀Ether Price: $3,419.31 (12.03%)

💪Bitcoin Dominance: 57.46% (−6.13%)

🏦Total Value Locked in DeFi: $124.9 billion (16.63%)

💳Total Stablecoin Market Cap: $213,825,852,068 (14.90%)

Percentage shown above is change since last newsletter

😨🤑 Krypto Fear and Greed Index:

🟡 Podcast-Episode “Less Noise More Signal”

geschrieben von Pascal Hügli

In our latest podcast, we shared our thoughts on what bullish (and less bullish) undercurrent there are for Bitcoin in 2025. Key questions are:

Is the cutting cycle over?

Is inflation coming back?

Is the dollar getting even stronger?

What does the current Trump Put mean for BTC?

Do Saylor's recent moves foreshadow a SBR?

Why is MicroStrategy still widely misunderstood in 2025?

Is the Bitcoin-Stablecoin-Flywheel-Effect the biggest catalyst for Bitcoin going forward?

Enjoy. And please leave a like (and comment) on this particular video. This really helps the show to grow!

Be aware: The article below covers the topic in more detail!

🟡Market Update: Our regular overview give us now🙏

written by Pascal Hügli

Shadow liquidity was ample

We continue to believe that liquidity is essential for financial markets, especially risk assets like stocks or digital assets. See this recently updated chart on the correlation.

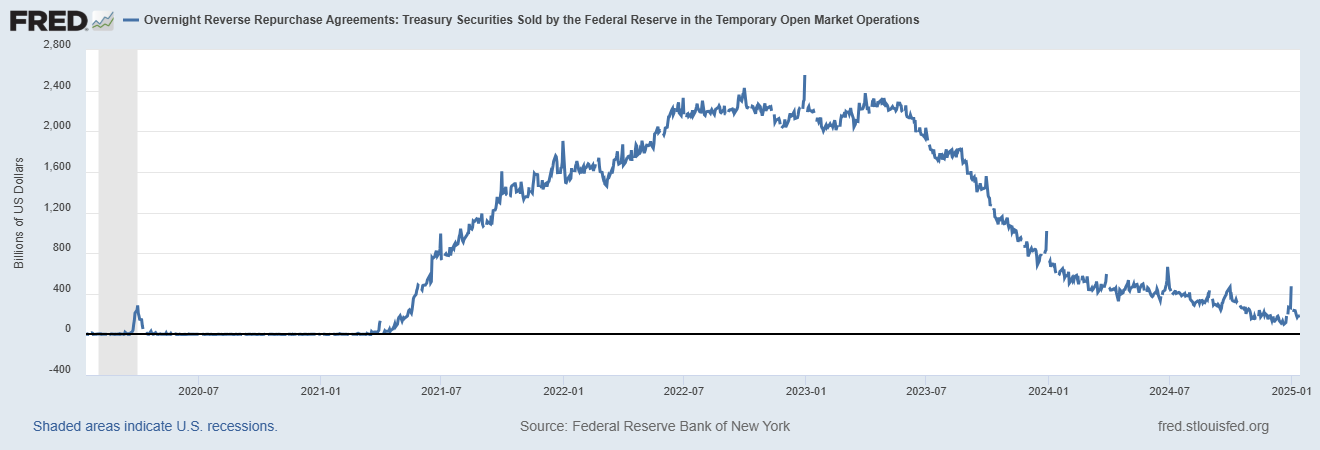

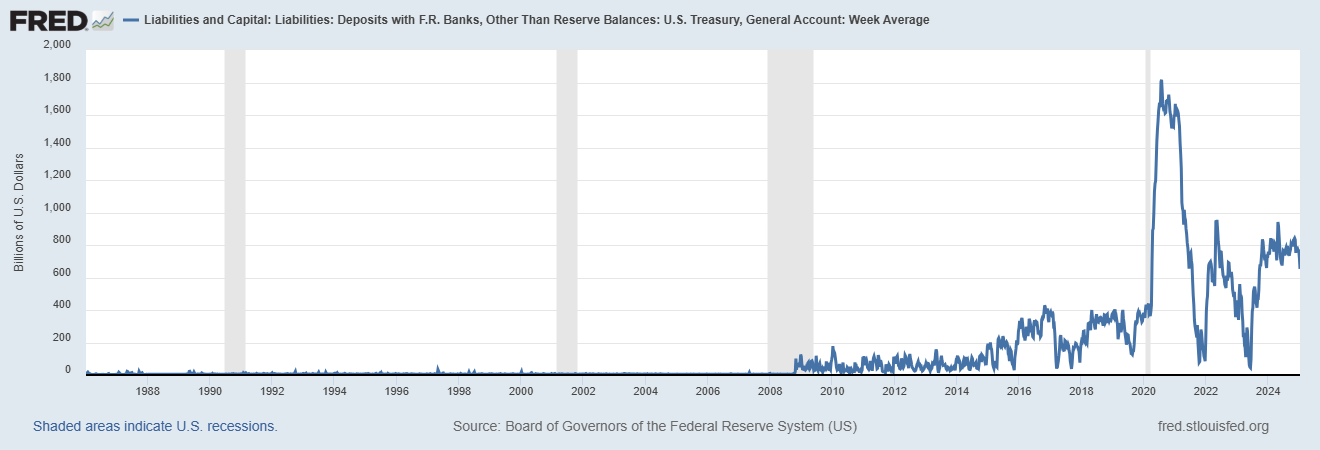

Despite quantitative tightening (QT) in recent years, 2024 saw a net liquidity injection of $2.3 trillion via the reverse repo facility and $170 billion from the Bank Term Funding Program (BTFP). Concurrently, increased Treasury bill issuance bolstered liquidity.

As we have moved into 2025, the Reverse Repo Program (RRP) is nearly depleted, and the BTFP is almost repaid. If the RRP is exhausted, QT may start reducing bank reserves, likely ending by March 2025. Wall Street consensus aligns with this timeline.

The U.S. debt ceiling, reinstated on January 2, 2025, further complicates liquidity. A temporary funding bill delays shutdown concerns until March, emphasizing critical timing for these challenges.

Debt ceiling drama, again

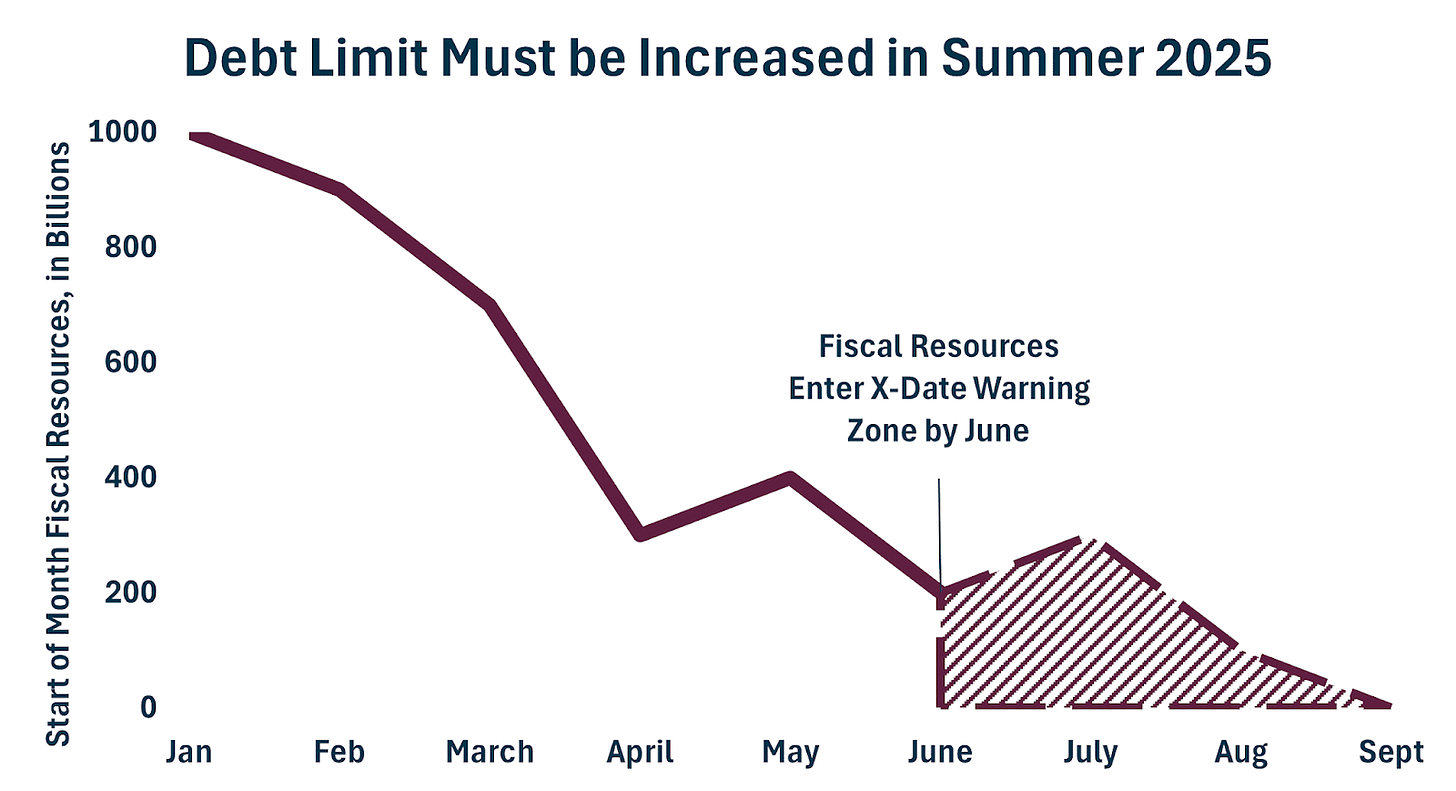

Liquidity is significantly impacted by the U.S. debt situation. Congress holds the sole authority to set a limit on the aggregate amount of national debt that the government can carry at any given time, and this is managed by the U.S. Treasury. The current situation regarding the debt ceiling for 2025 is unfolding with significant implications. The federal debt limit was reinstated on January 2, 2025. However, the current Congress successfully postponed a potential government shutdown by passing a temporary funding bill amounting to approximately $1.5 trillion, which extends federal spending until March 14, 2025. This is when the debate about raising the debt ceiling will heat up again.

Looking further ahead, the so-called "x-date," the point at which the government could run out of funds, is projected to occur in August 2025. Without an earlier increase to the debt ceiling, the Treasury General Account (TGA) will likely drain with intermittent fluctuations until the summer of 2025. Currently, there’s about $700 billion left in the tank.

Such a spenddown acts as a liquidity injection, as it releases money already borrowed from savers. And because there will be a negative bill issuance due to the fact that bills will be retired, while no new debt in the form of bills can be issued because of the debt ceiling, the effects of “stealth QE” will stop for the time being. That also means QT will fully impact financial markets. On the margin, this should result in higher term premiums.

As a consequence, a TGA spenddown will be needed and followed through. As said, a TGA spenddown is literally a liquidity injection because it is money that was already borrowed from savers being released to the private sector. Thus, the negative bills issuance results in TGA funds being handed to private sector bills owners. However, a TGA drawdown will only be marginally positive because much of this liquidity is expected to flow into the reverse repo facility, making its overall impact liquidity-neutral.

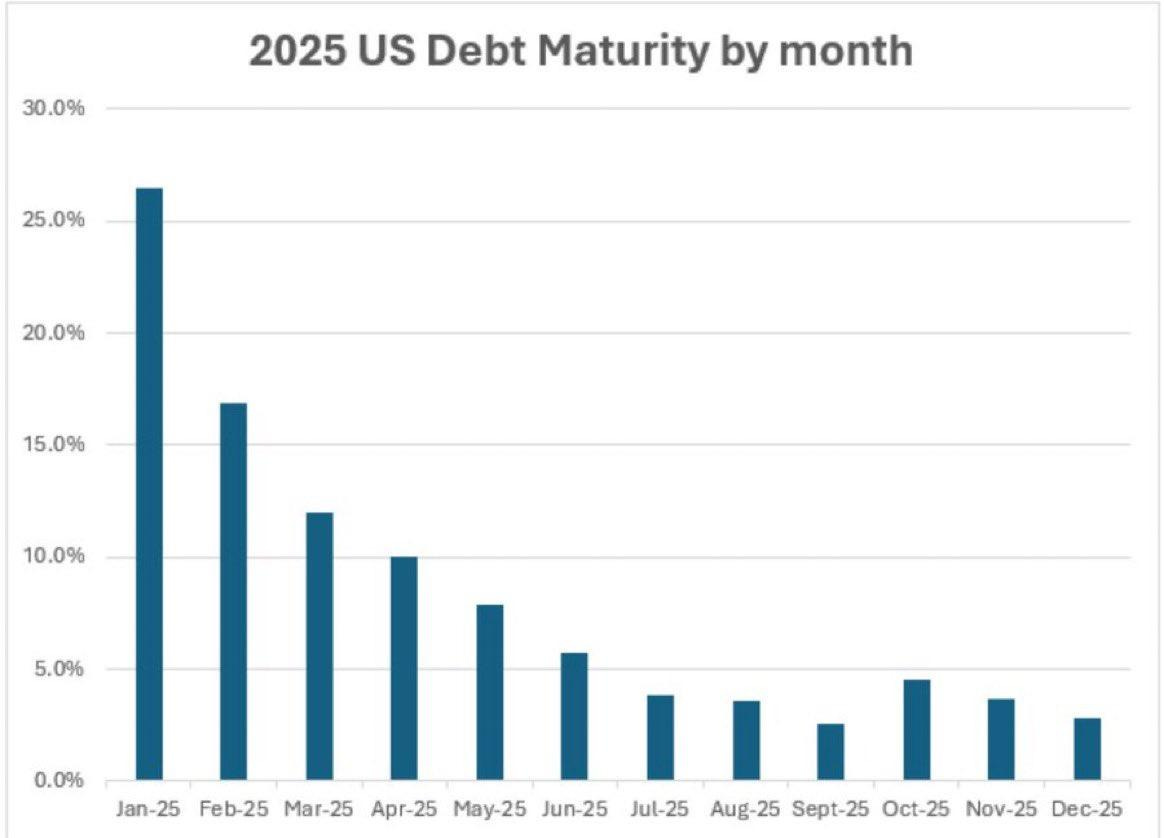

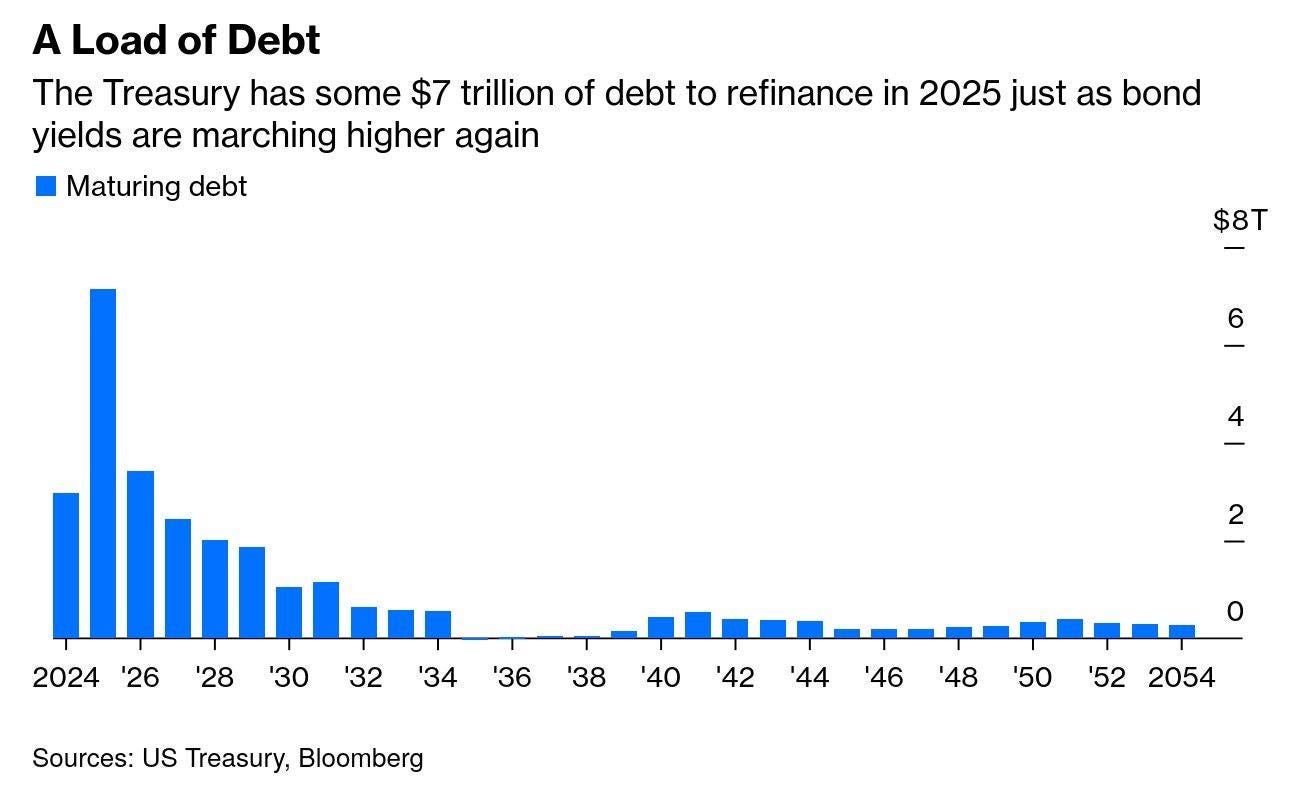

The debt refinancing wall

There will also be the so-called debt refinancing wall coming up in 2025. While refinance debt always represents a certain strain on the system, the fear that this need for rolling the debt in 2025 could overwhelm markets is overblown.

Currently, $6 trillion of the $7 trillion in debt that will need refinancing is in the form of bills, with an interest rate of 5%. These bills are expected to be refinanced at a lower rate of 4.25%, resulting in savings of $50 billion for the government. “Only” $1 trillion of the debt consists of older coupons paying 2.5%, which will be refinanced at 4.5%, leading to an additional cost of $20 billion. Overall, the net effect of these adjustments is a reduction in government debt costs by $30 billion.

What remains uncertain how the Treasury under Trump, led by Scott Bessent, plans to finance itself—specifically whether it will follow Janet Yellen's strategy of relying heavily on short-term Treasury bills. Whichever approach is chosen, the decision is expected to have a significant impact on the market. Treasury financing structure plays a critical role in shaping interest rates, investor sentiment, and broader financial conditions, making this choice pivotal not only for managing government debt but also for maintaining market stability.

Should the new Treasury Secretary, Scott Bessent, choose to extend the maturity of the debt, it could disrupt the supply-demand balance at the long end of the yield curve, potentially driving yields higher. A key factor behind the recent spike in yields (though they have since eased from their highs) is market anticipation that Bessent will indeed pursue a strategy of lengthening maturities and normalizing U.S. issuance policy. Curiously, however, Bessent offered little indication of his intentions during his recent confirmation hearing.

Inflation – probably not going anywhere:

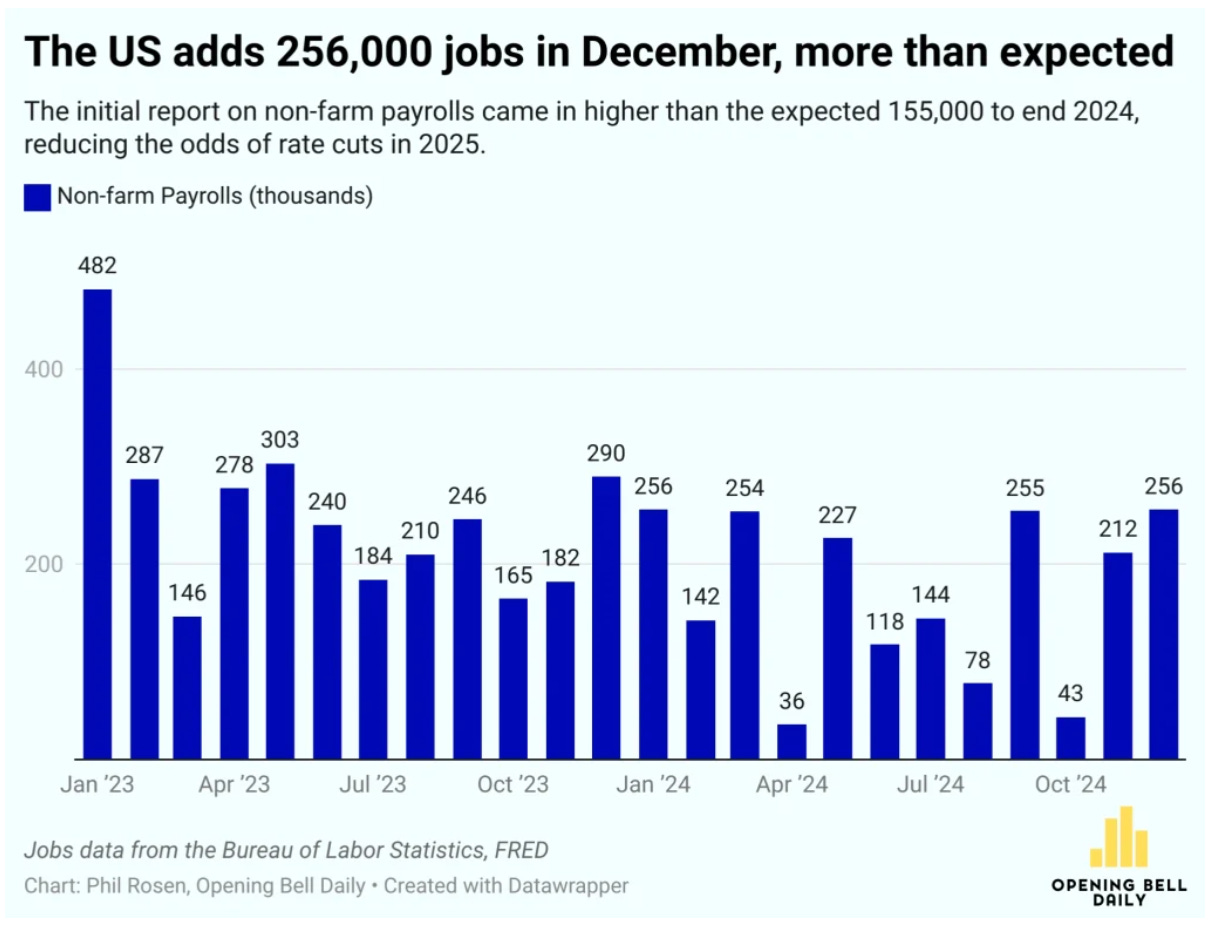

Another factor behind the recent rise in bond yields has been a stronger economy, creating the familiar paradox where “good news is bad news.” This dynamic was highlighted by the latest jobs report, which pointed to robust economic conditions. Non-farm payrolls exceeded expectations, reinforcing the market's perception of economic strength.

This has prompted the U.S. central bank to adopt a more hawkish stance once again. As Jerome Powell often emphasizes, the Fed is data-driven, and recent data indicates that the pace of inflation’s deceleration has slowed. While the six-month inflation trend remains negative, the three-month trend has turned slightly positive, suggesting a potential uptick in inflationary pressures.

As a result, inflation expectations for 2025 have risen, as reflected in both the TIPS market and consumer surveys. Investors are now questioning whether rising inflation could prevent central banks worldwide from pausing or reversing further rate hikes. However, it seems unlikely that inflation will meaningfully reverse upward in the near term.

For one, the strong jobs report can be seen as a direct result of Trump’s election win, which played out in December following November’s election. The rationale here is that the resolution of uncertainty prompted companies that had been waiting for the election outcome to ramp up hiring. However, this effect is likely to be short-lived.

When examining inflation, it’s true that interest rates have remained higher for a longer period over the past two years, yet the U.S. economy has shown remarkable resilience. This resilience is due in part to factors like onshoring, the prevalence of fixed-rate mortgages over adjustable-rate ones, and a tight labor market. Another contributing factor is the current fiscal dominance environment, where higher government deficits contribute to inflation. For further insights, see Lyn Alden’s most recent article on this topic.

However, as we move into Q1 of 2025, many of these supportive factors—aside from fiscal dominance—are likely to diminish gradually, with growth already weaker compared to 2023. In fact, higher interest rates and persistently elevated yields should weigh on the economy, slowing growth marginally. Given this, it’s reasonable to assume that the market is currently mispricing the number of rate cuts expected in 2025, and that this figure should be higher.

On the topic of global growth, there are no positive signals from China either. This is underscored by its soaring bond yields, which are also bearish for global growth, adding further confluence to the prevailing economic concerns.

Growth scare mid-year?

If growth and inflation continue to deteriorate in the early months of 2025, we could see a shift towards what’s known as a "growth scare" by the summer. This could occur as the market suddenly pivots to concerns about an impending recession. While these fears may be valid, it’s unlikely that a recession will materialize in 2025. For further insights on how this scenario might unfold, check out this recent interview.

Trump’s tariff bluff…

Market participants have also been concerned about Trump’s indication that he will take a hard stance on tariffs. While his policies could introduce macro and liquidity risks, they are generally seen as growth-positive, benefiting risk assets like Bitcoin (BTC). However, these policies also come with inflationary pressures. Tariffs, a hallmark of Trump’s economic strategy, are theoretically inflationary. That said, it's likely that his tough rhetoric on tariffs is more of a negotiation tactic and will be softened in practice.

As we get closer to Trump’s inauguration, there’s increasing evidence that his strong rhetoric on high tariffs has been more of a bluff. It’s likely that he will backpedal and refrain from implementing tariffs as aggressively as initially suggested. Reports also indicate that the Trump administration plans to take a more moderate approach, with clear objectives focused on reciprocal trade. Wall Street didn’t anticipate a gradual increase in tariffs. Instead of an immediate shock, the strategy seems to involve a more subtle, incremental change—essentially "boiling the frog."

…and the strong dollar nobody actually wants

An overly aggressive tariff policy could also conflict with the global need for a weaker U.S. dollar. A continually strengthening dollar would put pressure on international markets, a challenge that Trump and his administration will need to address.

A global margin call on U.S.-denominated debt issued by non-U.S. entities could trigger significant financial stress due to the inherent dollar liquidity risk. Many non-U.S. entities, especially in emerging markets, issue debt in U.S. dollars to take advantage of lower interest rates, but this exposes them to currency mismatches. During financial turmoil or when U.S. interest rates rise, the demand for dollars increases, making it more difficult for these entities to service their debt. This can create a cascading effect, where the inability to meet dollar-denominated obligations forces asset sales, heightening market volatility and potentially leading to a broader liquidity crunch.

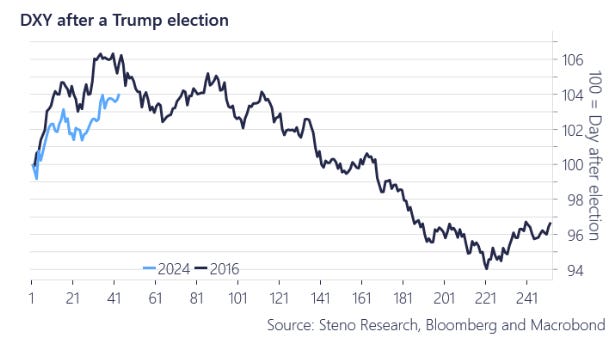

Currently, the recent sharp rise in the U.S. Dollar Index doesn’t necessarily signal reduced liquidity but rather reflects the market pricing in Trump’s economic policies, along with relative weakness in Europe. While the USD remains strong against the euro today, historical trends from 2016 and 2017—the last time Trump was inaugurated—suggest that this strength may represent the peak.

Bring down the deficit – say what?

Elon Musk and Vivek Ramaswamy's proposal to establish the Department of Government Efficiency (DOGE) aims to significantly cut back on government spending. While reducing government expenditures might appeal to fiscal conservatives, it could have unintended consequences for risk assets. Government spending often has a stimulative effect on the economy, providing liquidity and supporting financial markets. A substantial reduction in spending would be deflationary though, potentially posing challenges for risk assets like equities and bitcoin.

However, concerns about DOGE’s impact are likely overstated. There are basically two arguments, why DOGE will not have its desired effect, which also means that the risk of decreased government spending is also minimal:

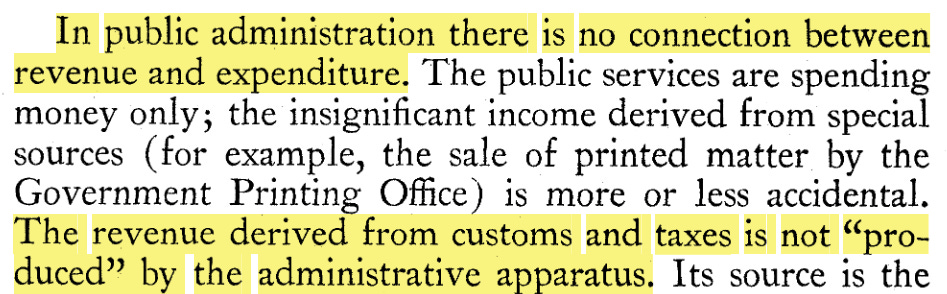

Structural and Fundamental Limitations: The Austrian economist Ludwig von Mises, in his seminal work Bureaucracy, explains why governments cannot operate like private enterprises. Unlike businesses, governments are not profit-driven and must serve broader societal goals, making efficiency-driven models inherently incompatible with public administration.

Macro and geoeconmic limitation: Foreign investors currently hold a short position in U.S. debt while maintaining a long position in U.S. assets. This dynamic introduces a critical vulnerability tied to the strength of the U.S. dollar. If the dollar strengthens further, the burden of U.S. debt becomes increasingly difficult for foreign holders to sustain. A stronger dollar raises the cost of servicing dollar-denominated debt, potentially prompting foreign investors to offload U.S. assets to reduce exposure. This selling pressure could destabilize markets, creating a feedback loop of declining asset prices and tighter financial conditions.

Trump won’t want to turn his back on crypto

From a high-level perspective, the administration is very "pro-crypto," as evidenced by the appointment of a crypto-friendly SEC chairman, Paul Atkins, and a dedicated AI and crypto czar, David Sacks. How much will this really help?

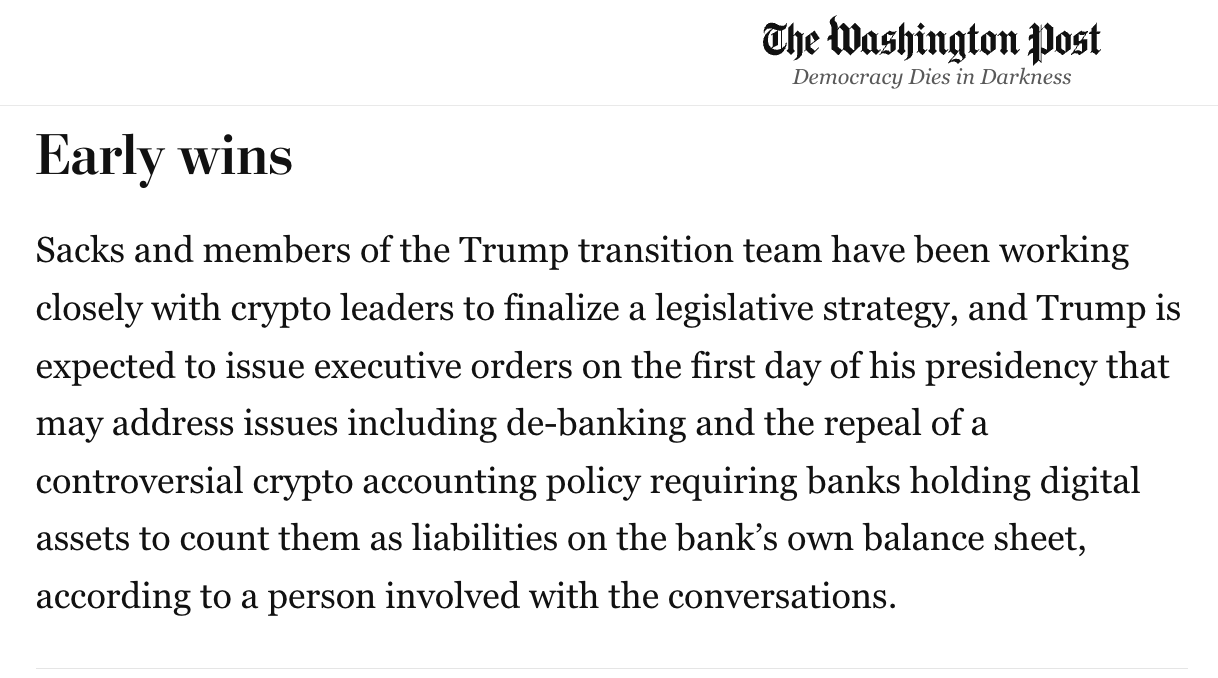

Quite a bit. In fact, the market still underestimates the vigor with which the Trump administration will pursue its crypto policies. The Washington Post recently reported that Trump is expected to issue executive orders on his first day in office, signaling swift action on this front.

The reason Trump and his allies are likely to follow through on their crypto promises is clear: crypto presents a significant opportunity for politicians. With over 50 million crypto holders in the U.S. today, this demographic has played a crucial role in securing decisive wins for Trump and the Republicans. This has been recognized, and as a politician, you don’t want to alienate these voters going forward. After all, this group is rapidly expanding, likely growing in the triple digits annually. In fact, crypto is already probably bigger than any other movement—larger than Black Lives Matter, Mormons, Digital Nomads, LGBTQ groups, or even Fridays for Future activists.

Strategic Bitcoin Reserve will happen – the question is how

Discussions about whether the U.S. government should buy Bitcoin are ongoing. According to a recent Forbes article, Trump is said to have reaffirmed his intention to build a strategic Bitcoin reserve. In a simplified form, the U.S. president could implement this independently through a presidential decree. In preparation for the January inauguration, the U.S. Bitcoin Policy Institute has already drafted such an executive order, which only requires the signature of the incoming president to become a reality.

Once this order is passed, the scope of the strategic Bitcoin reserve could be expanded with support from Congress. In fact, the Bitcoin Act, a bill already on the table, could help facilitate this. The bill’s sponsor, Senator Cynthia Lummis, recently posted a photo with Scott Bessent, the incoming U.S. Treasury Secretary.

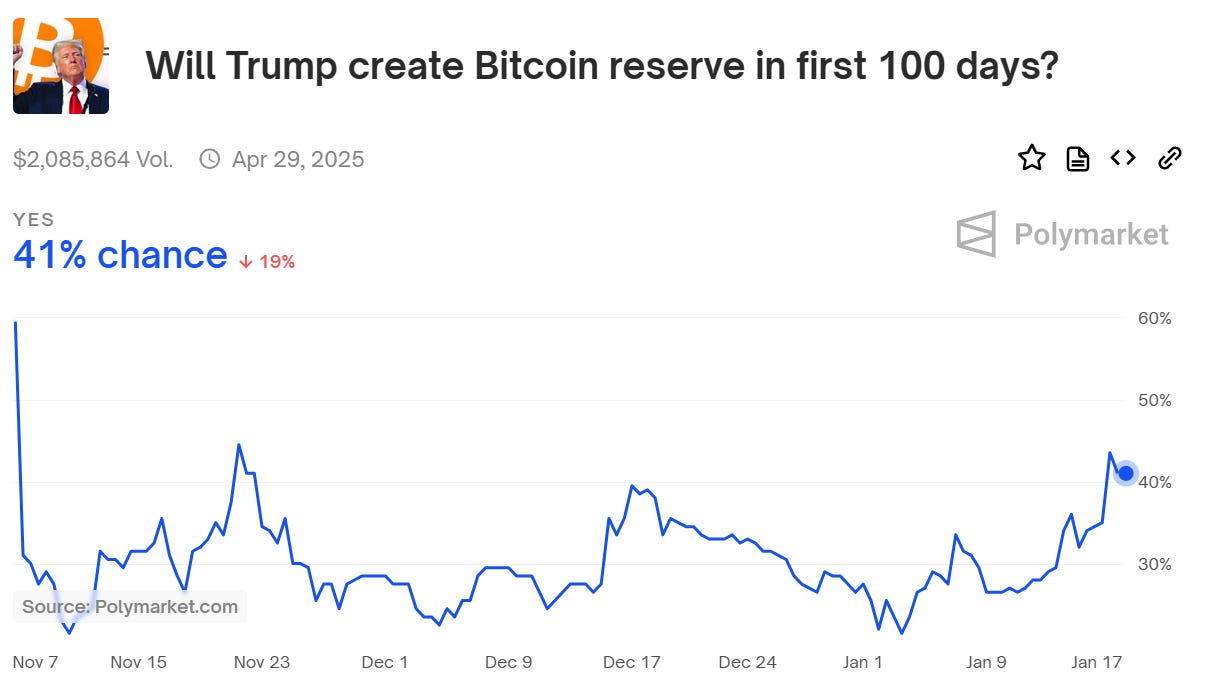

Despite these developments, the general market remains skeptical and still largely doubts that a U.S. Bitcoin reserve will materialize. This skepticism is reflected in the Polymarket prediction market, where the probability of the reserve being established is currently around 40%.

Another important development is the launch of a Bitcoin Bond ETF by Strive Asset Management. Why is this significant? Vivek Ramaswamy, co-founder and CEO of Strive, is part of Trump’s inner circle, which suggests that those closest to the president may have insights the broader market hasn't yet grasped. Regardless, this points to a growing vested interest in Bitcoin within the Trump administration.

The most likely scenario is that Trump may establish a Special Bitcoin Reserve (SBR), indicating that the 200,000 BTC seized by the government will likely not be sold anytime soon. With support from Congress and agencies like the Treasury, this reserve could expand, positioning Bitcoin as a strategic asset for the U.S.

It's also worth noting the existing connections between key policymakers and Bitcoin. Senator Cynthia Lummis, the sponsor of a prominent Bitcoin bill advocating for the U.S. Treasury to purchase up to 1 million BTC, has ties with Scott Bessent, the incoming Treasury Secretary. Bessent, who reportedly owns Bitcoin, would likely need to divest his holdings to avoid conflicts of interest, further underscoring the increasing role of Bitcoin in government policy discussions.

But here’s where it gets even more intriguing: what if MicroStrategy has already burned through 70% of the largest ATM offering in capital markets history in just three months, rather than the planned three years? Could they know something that the rest of the market doesn’t? Perhaps they’re anticipating that Trump might take even further steps.

After all, a recent photo of Michael Saylor with Eric Trump has sparked a great deal of speculation. While it’s all speculative for now, the buzz surrounding these developments is impossible to ignore.

MicroStrategy – still going strong, still misunderstood

Speaking of Saylor, we must also touch on MicroStrategy. In its ongoing rush to acquire more Bitcoin, MicroStrategy recently announced a Special Meeting for shareholders, scheduled for January 21—just one day after Trump’s inauguration. The meeting will focus on key proposals to accelerate the company’s 21/21 Plan, streamline capital-raising efforts, and align director compensation with its Bitcoin-focused vision.

MicroStrategy’s strategy revolves around pulling forward years of buying power, part of which involves issuing preferred shares. These shares come with an embedded call option and dividends, offering a unique combination of growth potential via the call option and income stability through the dividends. Even if the call option is deep in the money, its long expiration (or indefinite nature) still holds significant value.

This innovative financial product is another way MicroStrategy is tapping into traditional finance markets, aiming to unlock massive capital from its vast reserves. By leveraging resources from traditional finance, the company continues to push its Bitcoin agenda forward with increasing speed and ambition. It’s yet another product designed to access the enormous capital pools in TradFi markets.

Given this approach, it can be assumed that MicroStrategy will continue buying Bitcoin in 2025 by issuing its own shares and convertible bonds. The company’s addition to the NASDAQ index on December 23 further fuels the momentum around Bitcoin purchases. On the day of inclusion, over $2 billion is said to have flowed into the stock. Being part of the U.S. technology index means that MicroStrategy will naturally benefit from continued passive inflows. The premium on its shares over the Bitcoin it holds is likely to remain high, allowing the company to capitalize on this premium through share sales and borrowing to acquire more Bitcoin.

If Bitcoin continues to experience upward volatility in 2025, it could even be included in the S&P 500. However, MicroStrategy doesn’t yet meet all the criteria—such as consistent profitability—since it has not been officially profitable in three of the last four quarters. This is due to the challenge of accurately valuing its Bitcoin holdings under current accounting standards.

That said, this obstacle may soon be a thing of the past. New rules for the market valuation of Bitcoin went into effect on December 15, 2024. These changes will allow MicroStrategy to recognize its previously unrealized gains on Bitcoin (~$41bn market value vs ~$25bn purchase value), improving its outlook for the S&P 500. Under the new rules, MicroStrategy can classify Bitcoin as a financial asset and value it at market value, which will positively impact the company’s earnings if Bitcoin rises above $100,000. If MicroStrategy is added to the S&P 500 in 2025, this would likely boost its stock and, by extension, further fuel Bitcoin’s momentum.

If Bitcoin appreciates significantly, other companies holding Bitcoin will report large unrealized gains on their P&L under the new FASB rules. According to MicroStrategy’s most recent 8-K filing, the FASB change will lead to a net $12.7–$12.8 billion increase in retained earnings, driven by a $17.9 billion rise in Bitcoin’s fair value, offset by deferred tax liabilities and asset adjustments.

While retained earnings don’t affect the income statement, if Bitcoin has a strong Q1 and MicroStrategy continues adding, positive BTC gains could be reflected in the income statement. This would likely lower MicroStrategy’s P/E ratio (as earnings rise faster than stock price in the short term). If the stock price doesn’t immediately adjust to reflect the new earnings, the P/E ratio could temporarily drop to very low levels (e.g., 1x), signaling that the stock is undervalued and creating a potential buying opportunity. If the company’s stock eventually trades at multiples comparable to the Nasdaq average P/E of 36.68x, its stock price could rise dramatically to align with broader market standards.

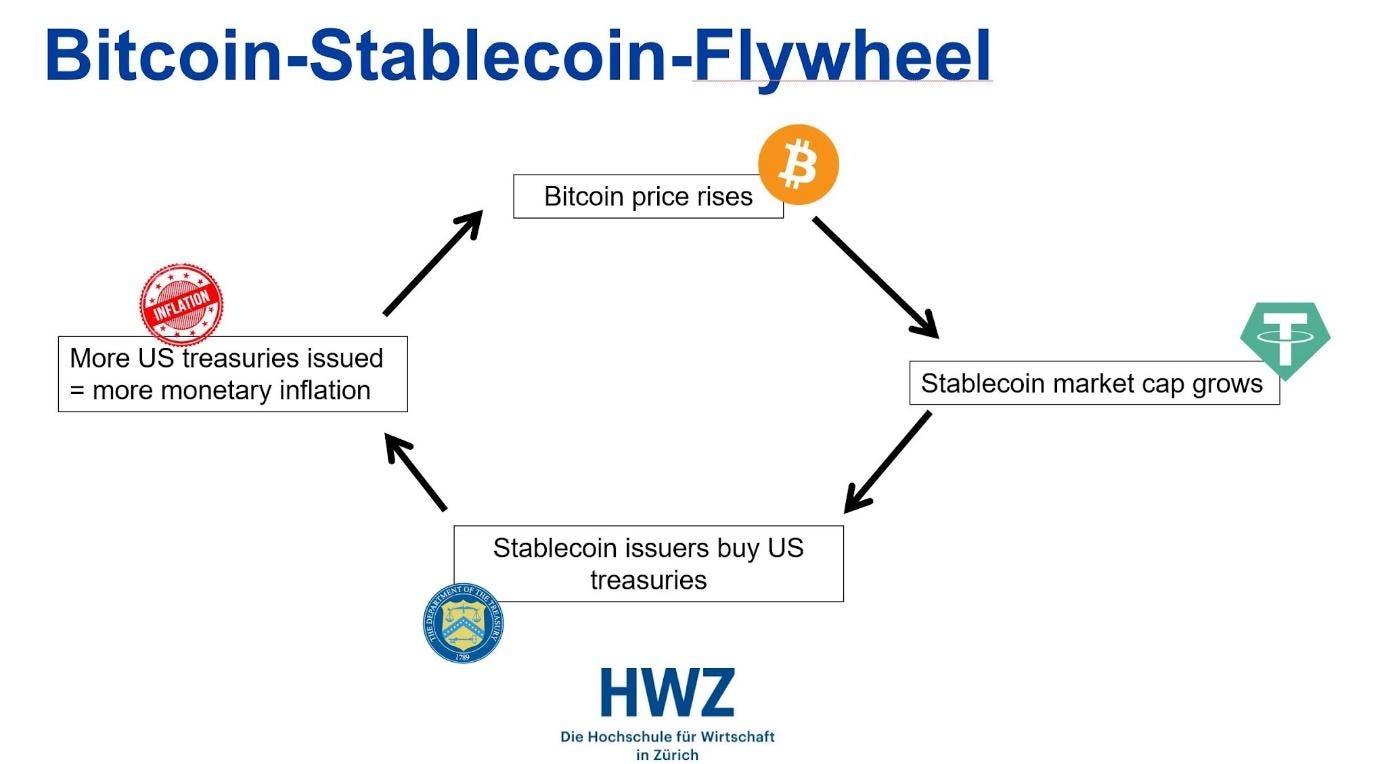

Bitcoin-Stablecoin Flywheel

The biggest catalyst could actually be stablecoins. How so? This could be cause because of something called the Bitcoin stablecoin flywheel.

First, we need to address what’s coming for stablecoins. In terms of U.S. politics and favorable regulatory changes for crypto, stablecoins are likely to be among the primary beneficiaries. In fact, there is already a stablecoin bill on the table—the Lummis-Gillibrand Payment Stablecoin Act—which has a strong chance of being passed into law in 2025. With bipartisan support in Congress and a Trump administration keen on promoting financial innovation, it seems very likely that a comprehensive stablecoin bill will pass. If this happens, the market capitalization of stablecoins is poised to grow rapidly, as the lines between centralized crypto exchanges, global payment platforms, and traditional fintech companies blur, with many of these players merging into next-generation consumer super apps.

This brings us to the Bitcoin-stablecoin flywheel effect. While we are still uncertain about the exact causality of these mechanisms (and whether they reflect more correlation than causation), we want to explore this because we are learning alongside our readers.

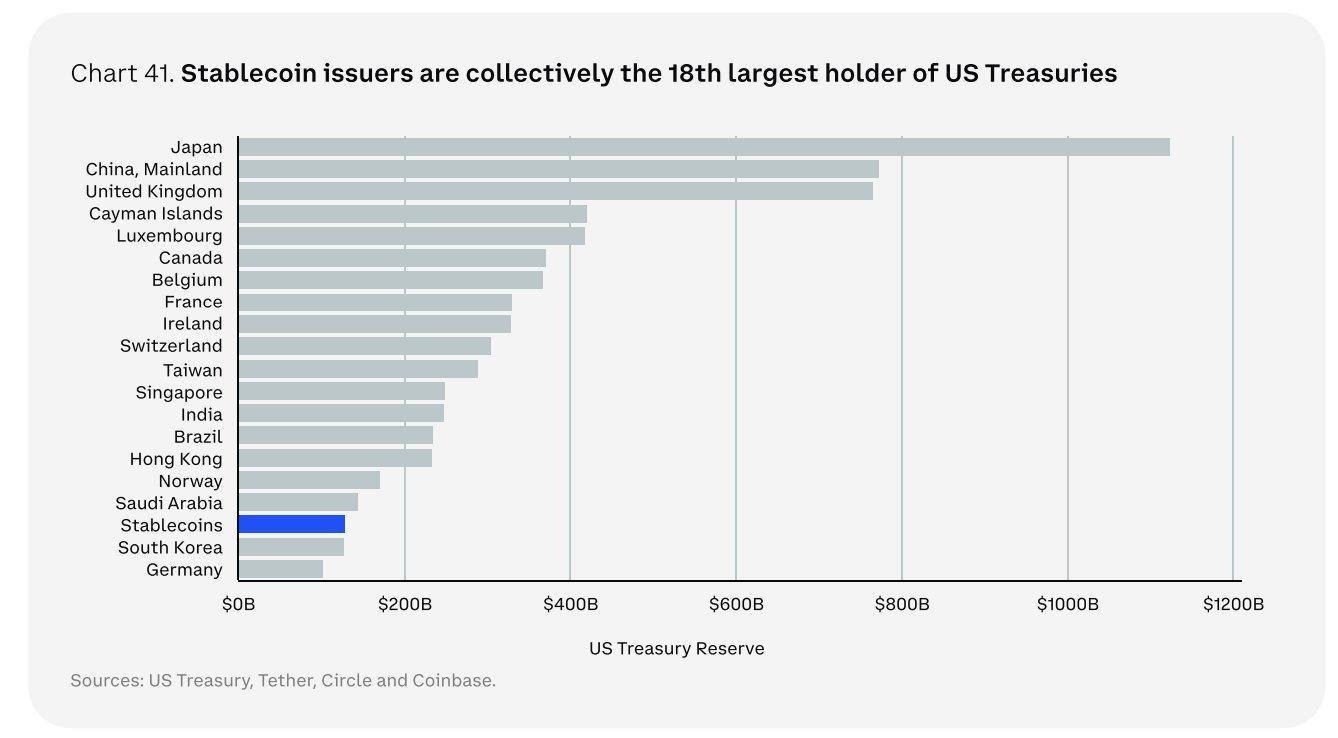

So, let’s break it down: As the stablecoin market cap expands, stablecoin issuers will need to accumulate more U.S. Treasuries to back their coins. This growing demand will be met by increased Treasury issuance from the U.S. government. Companies like Tether are already buying up short-term government paper issued by the U.S. government. At the end of Q4 2024, Tether held approximately $105 billion in U.S. Treasury bills. In fact, stablecoin issuers, as private companies, have become the 18th largest holder of U.S. government debt, surpassing many sovereign nations.

The Treasury Borrowing Advisory Committee recently estimated that around $120 billion in stablecoin collateral is directly invested in U.S. Treasuries, which represents approximately 2.5% of all outstanding Treasury bills. They also noted that “structural demand for Treasuries may increase as the digital asset market cap grows,” particularly as stablecoins are increasingly seen as a hedge against volatility and an "on-chain" safe-haven asset. Given current trends, it's not out of the realm of possibility for stablecoin demand for U.S. Treasury bills to reach $1 trillion, potentially making stablecoin issuers a major player in the Treasury bill market, accounting for up to a quarter of the total market.

As the stablecoin market continues to expand, so too will its demand for U.S. debt, especially short-term Treasuries. This growing demand will inevitably lead to more monetary inflation over time, providing a significant tailwind for Bitcoin's price. Why is that?

Short-term government debt, such as Treasury bills, is rolled over frequently and remains highly liquid—similar to cash. More broadly, government debt has been financed through balance sheet expansion by both banks and central banks, which has contributed to what’s known as "Wall Street inflation"—a direct push on asset prices. Bitcoin, as a hedge against monetary inflation, stands to benefit from this inflationary environment. As Bitcoin’s price rises, stablecoin activity and market capitalization tend to grow as well. This creates a virtuous cycle: higher Bitcoin prices fuel increased stablecoin demand and growth.

Indeed, a higher Bitcoin price typically leads to more trading activity on crypto exchanges. Major trading pairs on these exchanges are BTC/USDT (and to a lesser extent BTC/USDC). Back in 2020, BTC/USDT trading volume was more than seven times higher than BTC/USD. Although this has decreased somewhat, stablecoins still dominate in terms of trading volume over fiat currencies.

Additionally, a higher Bitcoin price drives demand for BTC. Much of the capital inflow into BTC still flows through USDT, with USDT being minted and sold for BTC, thus increasing Bitcoin's market cap. However, due to Bitcoin's volatility, a significant portion of profits is often taken and hedged back into stablecoins. This dynamic structurally boosts the market cap of stablecoins.

Lastly, some Bitcoin is also used as collateral to mint stablecoins (either through centralized or DeFi services). While still a minor force, this trend is increasing and is expected to continue over the coming years.

Last but not least: Bitcoin Price “Predictions”

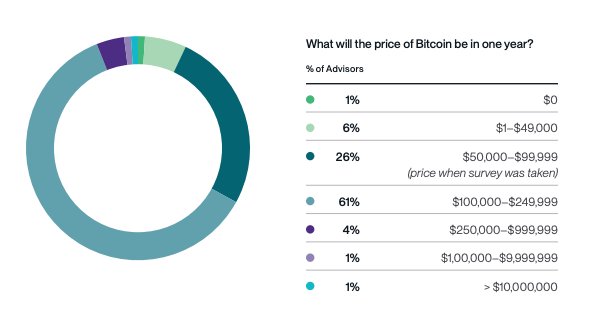

We can’t wrap up this piece without dropping some price predictions. Let’s turn to Bitwise’s latest annual survey, where they asked several hundred financial advisors for their Bitcoin price forecasts.

Interestingly, 61% of advisors believe Bitcoin will be priced between $100k and $250k by the end of 2025. And let's give credit where it's due—1% of respondents still think Bitcoin will go to zero! If you're curious about how other Bitcoin-focused firms view this year’s price outlook, check out this overview.