Understanding MSTR: How Strategy Fits Into the United States' Global Financial Endgame

What Strategy is doing, the product it sells, how investors can think about it, why its digital credit products matter, why MSTR lags Bitcoin, the main risks, and the possible endgame.

Thank you for sharing our newsletter with your colleagues and friends💪🏻🙏🏻

Let's gooo 🎢 What you can expect today:

Understand how Strategy is really raising capital to buy more bitcoin.

How Strategy’s developing yield curve can potentially be used to create a self-funding, low-leverage balance sheet that turns home equity into productive capital while keeping liquidity strong and protecting against downside risk.

Why historical precedents from the (government) bond markets would suggest there is product market fit for Strateg'y’s digital credit products.

How Strategy is actually under-leveraged and why this is the reason for MSTR to be lagging BTC.

Learn how Saylor wants to invigorate the MSTR trade

Understand the overall risks to Strategy

Discover the MSTR endgame and why the establishment of the Bank of England in the late 17-century is a great analogy for what’s to come.

Less Noise More Signal Social Media LinkedIn / Instagram / Twitter / Telegram / Nostr

Less Noise More Signal Podcast YouTube / Spotify / Apple / Rumble

Less Noise More Signal Is Back, Sharper, Smarter, and More Curated Than Ever ⚡

written by Pascal Hügli

After a period of restructuring and reflection, the Less Noise More Signal newsletter has found its edge again. Our mission remains unchanged: cutting through the noise to deliver clear, high-signal insights in macro, finance, money, and Bitcoin.

Over the past year, we’ve lived by that principle through our podcast — publishing more than 70 episodes with true GOATs like Lyn Alden, Luke Gromen, Jordi Visser, and James from Checkonchain. At the same time, we’ve been spotlighting the next generation of thinkers — Mel Mattison, Ben Kizemchuk, Lighthouse Macro, Michael from The DeFi Report, and many others.

Now, that same focus returns to your inbox.

The upgraded version of the LNMS newsletter continuously curates the sharpest thinking from the best analysts and publications. We currently track over 30 top-tier newsletters (and growing), each carefully selected to uncover the most valuable insights. Every edition will highlight the most relevant key takeaways, link to the original research, and — most importantly — connect the dots between the many pieces of content shared by the best analysts in macro, finance and bitcoin.

By reading LNMS you get the full load of knowledge from top experts without having to read all their content yourself just to stay up to date. And if you like, you can still do a deep dive every now and then!

We’re keeping the newsletter free until year-end, so you can experience the alpha and added value firsthand. After that, it will move behind a modest paywall. We rest assured that many of you will follow along as learn together from the brightest minds out there!

Now, let’s get stuck in with today’s knowledge-packed issue!

Rabbit hole, here we come!

I recently did an episode with Johan Bergman, a very astute and smart fellow that, besides his own gigs, writes for the Bitcoin Layer. One of the many pieces I read by Johan is Strategy (MSTR) & the BTC-Backed Yield Curve. Not only did this piece prompt me to invite him onto my podcast, but it also encouraged me to go deeper into Strategy myself.

In this piece, I want to share with you, what I’ve learned about what Strategy is actually doing, what the product is that they are selling, how to think about Strategy’s products as an investor, why these digital credit products are such a game changer (that has precedent and high product market fit when looked at it from a historical lens), why MSTR price is currently lagging the Bitcoin price, what the real risks are and what the endgame will look like.

What is Strategy actually doing?

Most people still don’t understand where Saylor gets his money from when he’s buying bitcoin. A lot of the basics are discussed in the above-mentioned LNMS episode with Johan. But here’s a primer.

First off: Strategy is not sitting on a pile of cash that they are “deploying strategically”. Only the very first buys almost 4 years ago were actual cash deployments!

Today, when Strategy buys bitcoin, they are actually selling something else. This something else can either be:

Their common stock MSTR: Strategy issues new shares and immediately sells them onto the market. This is referred to as an “ATM”, also known as “at-the-market offering”.

Or any of his 4 preferred shares (STRF, STRC, STRK, STRD): The same mechanics apply here as new shares are being issued and sold into the market.

Strategy used to also issue convertible debt, but Saylor and team have backed away from doing this because of various reasons (discussed in the episode with Johan).

WTF are STRF, STRC, STRK & STRD about?

In the article below, Johan does an excellent job of distinguishing between Strategy’s various preferred securities within the capital stack, explaining how they compare to traditional preferred stocks and bonds, and clarifying the type of risk environment each is designed for.

It is Strategy’s foremost objective to accumulate as much Bitcoin as possible. Saylor has become known for buying near local Bitcoin tops, yet for him this is irrelevant in a strategic, long-term context. The short-term BTC/USD price is not his concern. The only thing he is doing is selling the above-mentioned instruments when it seems “accretive” to him, and in the capacity that the market/demand will allow him to execute.

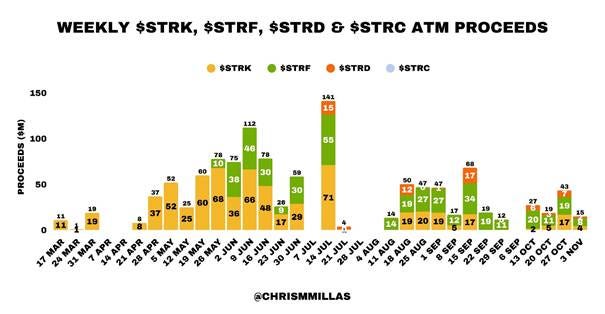

Looking at Strategy’s most recent ATM programs (see charts below), we can observe that the company has slowed the pace of MSTR share sales. While issuing MSTR is technically accretive as long as mNAV (enterprise value divided by assets on the balance sheet) remains above 1, excessive dilution without strong market momentum tends to put downward pressure on mNAV.

In theory, Strategy could raise 500 million dollars in a week by selling MSTR shares to buy more Bitcoin, but doing so would weaken the MSTR/BTC ratio. Saylor and his team are reluctant to pursue that path while the company’s mNAV is this low.

This is why the company’s current focus is on raising awareness around its preferred shares. These preferreds function similarly to debt instruments, and Strategy issues them when it believes its borrowing costs are favorable. The higher the market price of a preferred share, the lower the effective borrowing cost. For example, if STRK trades at 130 dollars, Strategy would likely issue and sell substantial volumes, whereas at 86 dollars, as is currently the case, it is far less attractive.

Among these, the most prominent is STRC, effectively a roughly 10 percent APR “stablecoin-like” instrument soft-pegged to 100 dollars with monthly payments. This is evident in trading activity, as STRC’s average daily volume is roughly equal to the combined volume of all other preferreds.

However, the preferred shares remain far less liquid than the common stock MSTR. Even if their prices rise, which would indicate cheaper borrowing for Strategy, the company would still face practical constraints on how much capital it can raise within a given week.

What does the liquidity picture look like for Strategy’s preferreds?

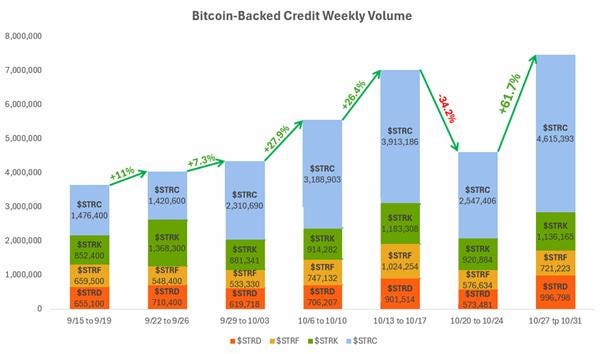

Jackson Fairbanks is regularly providing great overviews on the changing volume for the individual preferreds. It’s been growing steadily.

Using the ATM on the common stock (MSTR) allows Saylor to raise significantly more cash to purchase Bitcoin than the ATM on the preferreds. This means that every week he chooses not to sell MSTR shares is a week in which the company can only add a relatively small amount of Bitcoin to its holdings.

What stands out is that Strategy has hardly used the ATM on STRC, as they appear to be waiting for it to trade above 100 dollars. Based on Saylor’s recent actions and comments, this preferred instrument is viewed as the most important product going forward. The company’s priority seems to be building investor confidence in STRC first, rather than diluting shareholders too early.

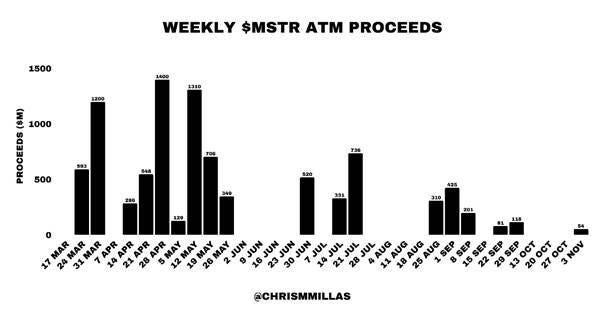

Chris Millas has provided a good overview on Strategy’s recent ATM usage:

What’s the product?

As Saylor himself put it, “We are selling credit. Selling credit is the product.” Strategy has effectively redefined what it means to issue corporate securities. The company took the concept of an At-The-Market (ATM) offering—a mechanism that allows a firm to sell its own shares through a broker on a stock exchange at prevailing market prices—and applied it to preferred stock.

Saylor explained it succinctly: “We’re selling U.S. dollar yield to create Bitcoin yield. That’s the swap.” Equity investors value the company based on the Bitcoin yield, or the appreciation of Bitcoin per share, while credit investors value the preferred securities based on their US dollar yield. Strategy’s model effectively converts fiat yield into Bitcoin yield, with Bitcoin serving as the collateral bridge between the two. In essence, that conversion mechanism is the core of Strategy’s business.

How to think about Strategy’s products as an investor?

Strategy’s digital credit products can be used in many different ways. One relatively conservative balance sheet approach using STRF, STRC, and BTC is described below. It is something folks could think about with their parents (homeowners) While this is obviously not financial advice, it’s an interesting thought experiment that can be tweaked as seen fit.

The goal of this setup is to create a self-funding, low-leverage balance sheet that turns home equity into productive capital while keeping liquidity strong and protecting against downside risk. It combines three main parts: a fixed-rate mortgage, a yield-paying instrument (STRF), and a strategic fiat reserve (STRC). Any extra cash flow is then invested into Bitcoin to capture long-term upside potential.

1. Core Setup

Home value: $1,200,000

Existing mortgage: $400,000

New draw: $400,000 (interest-only, 30-year fixed at 4%)

Total mortgage: $800,000

Equity: $400,000

Post-draw LTV: 66.7%

This creates a conservative starting position with nearly one-third equity buffer. The 30-year fixed structure eliminates refinancing and rate reset risk.

In addition, from the outset, an Interest Buffer Account is established using part of the new draw. This buffer is critical because STRF dividends are paid quarterly, while mortgage interest payments to the bank are likely required monthly. The buffer ensures uninterrupted monthly interest payments from day one, even before the first STRF dividend arrives.

2. Mortgage Interest Cost

The $400,000 new draw carries a fixed cost of 4%, or $16,000 per year in interest.

This is the key cashflow that must be neutralized to achieve positive or flat carry.

To ensure consistent payments, $16,000 from the new mortgage proceeds is allocated to the Interest Buffer Account, equivalent to one full year of interest payments ($1,333 per month × 12). This account automatically services the monthly interest obligations to the bank, while quarterly STRF dividends subsequently replenish it.

3. STRF – Interest Coverage Sleeve

The Structured Trust Preferred (STRF) provides a 10% nominal dividend on $100 par, currently trading at $110.21, resulting in a 9.07% effective yield. After a 25% tax assumption, the net yield is approximately 6.8%.

An allocation of $235,000 to STRF produces:

235,000 × 6.8% = 16,000/yr

This fully offsets the mortgage interest expense, effectively self-funding the debt service from portfolio income.

However, since STRF pays quarterly, its dividends flow into the Interest Buffer Account, which then releases funds monthly to cover the mortgage interest. This eliminates any timing mismatch between income and payment obligations.

4. STRC – Strategic Fiat Reserve

A $50,000 allocation to STRC serves as a liquidity and safety buffer, designed for use if housing prices fall or the lender requests a curtailment.

STRC offers a 10.38% effective yield, but in this plan, its cashflow is not required for interest coverage. Instead, STRC is held near par, emphasizing stability and accessibility.

If the housing market falls from $1.2 million to $1.0 million, the loan-to-value rises from 66.7% to 80%. By deploying the $50,000 STRC reserve to reduce the mortgage balance (from $800,000 to $750,000), LTV drops immediately to 75%, restoring a comfortable cushion.

The income generated from STRC (roughly $5,190 per year) is regularly swept into Bitcoin, steadily compounding BTC exposure over time while maintaining the reserve principal intact.

5. Bitcoin – Long-Term Upside Sleeve

The residual $99,000 from the new loan draw (after funding STRF, STRC, and the Interest Buffer Account) is allocated to Bitcoin, representing the asymmetric upside portion of the structure.

This sleeve is not relied upon for liquidity; its purpose is long-term capital appreciation and portfolio convexity over the 30-year mortgage term. Bitcoin remains untouched during market stress—no forced sales.

This structure ensures no timing mismatch, maintains consistent debt servicing, and steadily compounds BTC exposure from fiat-based yield streams — all while keeping the overall loan-to-value comfortably conservative.

6. Risk:

Bitcoin underperformance: Bitcoin’s long-term price appreciation fails to outpace the fixed liabilities the strategy must service, undermining the compounding thesis.

MicroStrategy / Saylor execution risk: Strategic or operational missteps, excessive leverage, or regulatory actions could erode investor confidence and depress the value of the preferred instruments.

STRF dividend suspension or deferral: STRF coupons may be deferred for multiple quarters, disrupting the interest-coverage mechanism and forcing reliance on reserves.

STRC market de-peg: STRC’s market price may fall below its intended ~$100 stability range if liquidity evaporates or credit spreads widen, reducing its reliability as a near-par liquidity reserve.

Preferred-issuance dilution: New STRF or STRC offerings could increase supply, depress market prices, and widen yield spreads, reducing capital efficiency.

Regulatory or accounting shocks: Adverse changes in financial-market regulation or accounting treatment of preferreds could impair valuations or restrict distributions.

Political capture risk: MicroStrategy’s Bitcoin holdings could become a political or regulatory target if sentiment turns hostile toward corporate BTC exposure.

Real-estate collateral decline: A significant drop in home value could lift loan-to-value (LTV) above 80%, potentially triggering lender pressure for principal reduction.

There are certainly more risks that are not thought of here! In fact, I’d love to hear from readers, what additional risks they see.

Historical precedent shows product market fit

Now, after this practical thought experiment, we want to return to the big picture.

What Saylor is doing with Strategy and its preferreds seems very new and exotic to most investors, when in fact, there is great historical precedent showcasing the preferreds product market fit. How so?

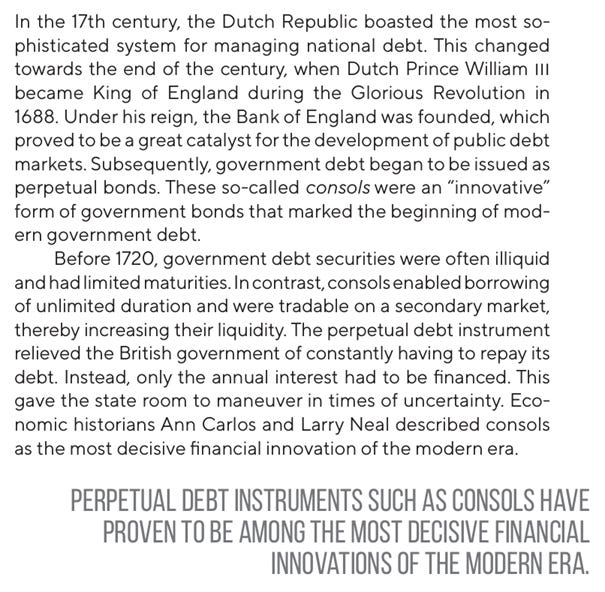

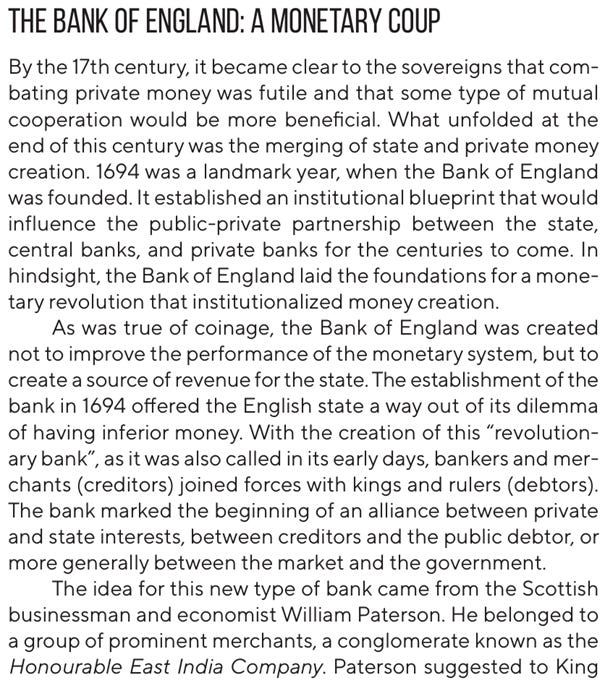

Some have been referring to Strategy’s preferreds as tokenized bonds. However, they don’t mimic any bond, but a very specific type of bond: a perpetual bond. In a recent podcast, Saylor himself entertained the analogy, and actually compared his instruments to consols!

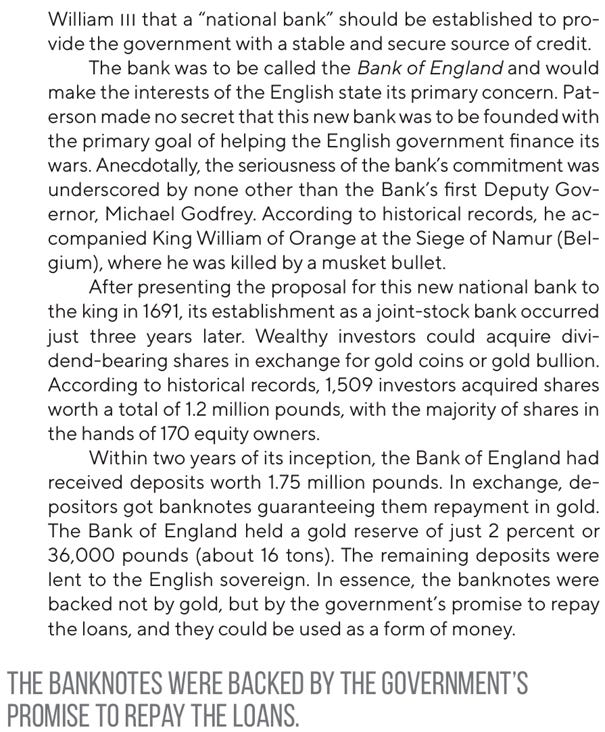

Consols were a type of perpetual government bond issued by the British government beginning in the mid-18th century. The government would borrow money from investors by issuing these bonds, typically with a fixed annual interest rate (say 3–5%). The investor would receive interest payments (the coupon) forever, while the principal (the original amount invested) would never be repaid. This way, the bond was “perpetual” and had no maturity date.

Interestingly enough, we wrote about these consols in our recently published book, ‘The Bitcoin Enlightenment’. We did so in the context of government financing and how decisively important these consols were in the establishment of a serious government bond market, thus paving the way for today’s fiat money system!

As you can read in the excerpt above, consols were described as the most decisive financial innovation of the modern era. What Saylor is doing now is combining this long-forgotten instrument with Bitcoin, the most innovative idea of our time.

Just like consols, Strategy’s preferreds have no refinancing risk. There is no need to roll over or repay debt. It’s just the interest that needs to be paid continuously. This provides stable, predictable funding and is simple in structure (no complex mix of different maturities exists).

From the viewpoint of investors, they receive stable interest (for life). Because the bond never matures, there’s no refinancing risk for the issuer — reducing the chance of default. That makes the income more secure in the long run, which is valuable for long-horizon investors (pension funds, endowments, etc.).

Why then have we stopped issuing consols and other perpetual (government) bonds? To answer this question, we have to turn to a very sharp economist by the name of Lawrence White (we will have him on the podcast next year).

In his book Better Money as well as a paper he co-authored, White argues that fiat money discourages the issuance of long-term debt, let alone consols. This is because fiat money suffers from structurally higher inflation rates, and more importantly, higher expected inflation rates, which creates higher price level uncertainty at medium to long horizons.

The gold standard constrained inflation in a more credible way, thereby better pinning down inflationary expectations and better stabilizing the demand to hold money relative to income than the fiat money system that followed.

The value of the fixed interest payments could decline due to inflation, and rising market interest rates could make existing perpetual bonds less valuable and less attractive compared to newer bonds. Largely for that reason, long-term (e.g., 100-year) corporate securities, which were common before 1914, have now all but disappeared. Today, shorter-dated liabilities dominated.

While Strategy has not moved back to a gold standard, they have transitioned fully to the bitcoin standard. Given they have immensely strengthened their asset side with a hard cap capital called bitcoin, investors will increasingly feel reassured to hold perpetual liabilities because they are overcollateralized with hard money.

As more people will understand Strategy and its preferreds, the issuance as well as the holder base for these instruments will increase dramatically.

Why is MSTR lagging BTC?

Now some investors might be wondering: If Saylor is really re-inventing the greatest financial innovation of the modern era on top of Bitcoin, why has Strategy’s common stock been lagging as of late?

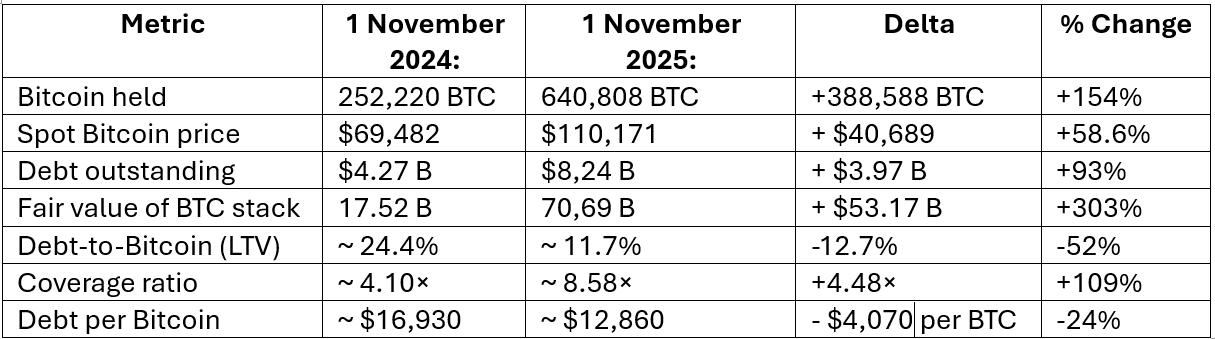

Well, it’s because Strategy is not leveraged enough! So far, it has been Strategy’s prescribed mission to outperform Bitcoin through leverage. However, as the below table shows, Strategy’s leverage has decreased on a year-over year basis.

On November 1, 2024, Strategy had a leverage ratio of about 24.4%. Now, exactly one year later, this leverage ratio has fallen to 11.7%. This is a 52% change! Given that MSTR has always been marketed as leveraged Bitcoin, it only makes sense that MSTR underperformed BTC by 35% since November 1, 2024.

How come, Strategy deleveraged so much over the past year?

The answer lies in its Bitcoin accumulation strategy: because dollar debt issuance did not keep up with the rising dollar value of its Bitcoin holdings, leverage decreased.

As a result, even though many uninformed observers worry that Strategy is “over-leveraged” and destined for a collapse in the next bear market, the opposite is true. Strategy is not excessively leveraged—it’s actually under-leveraged relative to the size of its Bitcoin base.

How and why did Strategy deleverage?

This has been succinctly explained in a recent video by Adam Livingston. Leverage has been perceived as the decisive factor, driving MSTR. If leverage comes down, so will MSTR’s outperformance against BTC.

Strategy’s Shift from Debt Leverage to Equity Amplification

The deleveraging effect is not a coincidence, but a deliberate strategy pursued by Saylor and the team at Strategy. They confirmed this approach in their most recent Q3 earnings call. This is because Strategy only just discovered the digital credit market.

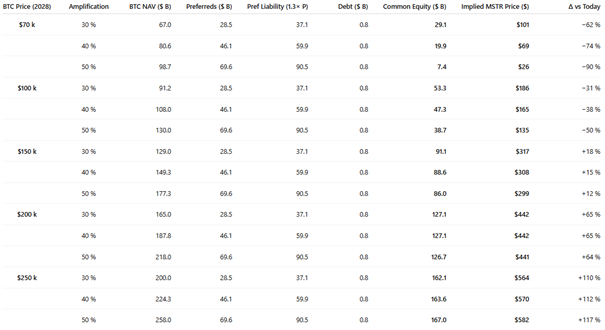

Looking ahead, the company intends to increase leverage through equity rather than debt. Saylor refers to this approach as amplification. The plan is to attract more preferred equity investors.

In technical terms, amplification represents the ratio of total capital raised—through either debt or equity—relative to Strategy’s Bitcoin holdings. Since the company plans to retire all existing debt by 2029, future amplification will depend entirely on the amount of preferred equity raised in relation to the Bitcoin stack.

The motivation behind this shift is clear. From Strategy’s perspective, using preferred equity reduces financial risk. Over time, this structure should also strengthen the position of common shareholders, as the company becomes more resilient. Preferred equity eliminates repayment obligations and maturity risk. It is generally perpetual, and dividends can be suspended if necessary (STRF, STRK, and STRC are cumulative though, only STRD is non-cumulative).

This approach introduces certain limitations. Raising preferred equity is typically slower and less flexible than issuing debt. However, Strategy appears willing to accept this trade-off in order to focus on what it considers the most stable form of leverage.

Under this new structure, common shareholders still have a path to benefit. If the company continues to finance Bitcoin purchases through preferred equity and Bitcoin appreciates substantially, then common shareholders’ returns may still exceed Bitcoin’s price gains—similar to debt-based leverage, but without the same default risk.

The reasoning is straightforward. Preferred equity holders receive a fixed dividend (except for STRC) and do not participate in Bitcoin’s upside (except for STRK, which converts into MSTR at $1,000 per share). Consequently, all appreciation beyond the preferreds’ fixed yield accrues entirely to common shareholders.

The level of amplification will depend on the amount of capital that Strategy can raise through preferreds. Our own scenario analysis suggests that an amplification of approximately 30 percent offers the most attractive balance between risk and reward. Higher amplification levels increase risk and complexity disproportionately, unless Bitcoin exceeds approximately $250,000 by 2028.

Key assumptions in our analysis:

Strategy’s total debt declines to $0.8 billion by 2028 as indicated by management

New preferred equity is issued at par to reach target amplification levels of 30 percent, 40 percent, and 50 percent (might actually be below par in reality)

The average across all preferreds is a 10 percent annual dividend, accrued over three years (1.3× total liability)

All proceeds are invested gradually in Bitcoin between 2025 and 2028 at an average price between today’s ($110,000) and the 2028 scenario range ($70,000–$250,000)

Debt, preferreds, and Bitcoin net asset value determine the residual common equity value

The residual equity value is scaled to today’s $77 billion market capitalization ($268.16 per share) to estimate implied MSTR share prices

We are aware of the fact that the above calculations are based on various, static assumptions and approximations.

For one, we have not assumed any further dilutions of MSTR or any of the preferreds, which we believe to be an unrealistic assumption.

Obviously, issuing additional MSTR shares until 2028 would reduce each share’s claim on Bitcoin holdings, lowering per-share upside. On the other hand, issuing additional preferreds until 2028 raises more capital to buy Bitcoin, but also adds fixed dividend obligations.

What’s the overall risks to Strategy?

After discussing Strategy and its overall approach in detail, it is important to conclude by addressing the risks.

There is obvious execution risk to Strategy. The question is whether management will continue to make the right decisions. Having shifted its funding strategy from monetizing volatility in the common stock to offering low-volatility, stable cash returns represents quite a turnaround. We believe this was the right move, but similar pivotal decisions will arise in the future, and investors must trust that Saylor and his team will continue to execute effectively.

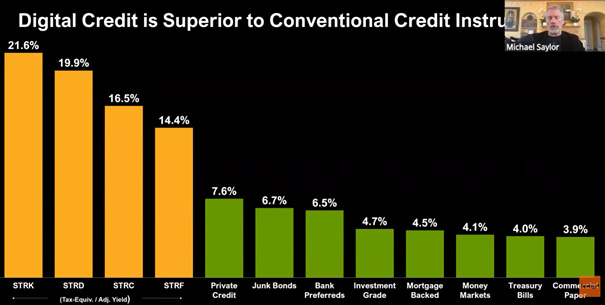

From a technical standpoint, Strategy’s preferreds remain highly attractive compared with traditional market securities, as illustrated in the slide below.

Whether or not traditional investors beyond retail will feel comfortable re-allocating parts of their fixed-income portfolio towards these preferreds is very much an awareness problem to date. Most money managers and bank advisors aren’t really paying attention. Strategy will need to convince them though, if they really want to raise $20 to $30 billion for the preferreds.

Getting the necessary awareness though, will be the smaller problem. The real challenge is earning trust. And trust will be needed. Having worked as an investment manager for a Swiss bank for the past 2 years has taught me this! Trust is the single most important determinant when it comes to how people invest their money.

What will help with the trust angle is a credit rating. For MSTR, Strategy just recently got its first credit rating from S&P Global Ratings, a ‘B-’. The rating is considered “junk” and reflects the company’s high concentration in Bitcoin, its reliance on capital markets, and its narrow business focus.

Is the ‘B-’ credit rating MSTR got good or bad?

On a recent podcast, Jeff Park clearly explained why obtaining any credit rating is an important first step, while noting that S&P Global Ratings still has to do a lot of homework.

The MSTR credit rating highlighted an important point on credit ratings. S&P’s methodology excludes unbacked tokens, like bitcoin, from equity. This mirrors the prohibitive Basel Accords rules on crypto capital requirements, which are also hindering banks from more fully integrating with digital assets. About two years ago, a good friend of LNMS, Luzius Meisser, elaborated on these restrictions.

Strategy will surely be hard working on getting credit ratings for their preferreds. And at some point, they will get it. What’s interesting is the fact that Saylor keeps on highlighting, how STRC is a “bank account that pays your 10%”. In his mind, there must be huge demand for such a product.

And while this sounds lucrative indeed, one question remains unanswered: Why did STRC IPO at a discount ($0.9 to the $1)? Doesn’t this somehow show that the demand does not really exist at full price?

One could argue that there is apparent demand, given that STRC is now trading at $99.38. But then again, this is because of an additional incentive given by Strategy, which is an increasing dividend. In September, Strategy decided to bump up STRC’s dividend from 9% to 10%. Then, in October, they decided to increase it yet another 50 basis points, which means that the preferred currently pays 10.50% annual dividend, payable monthly in cash. This has led more and more investors to buy STRC at the margin, driving up its price towards the $100 mark.

However, this mechanism is fundamentally a “soft peg”, it relies on market confidence, arbitrage, and the issuing company’s willingness and ability to adjust dividends or redeem shares to pull the market price back to par.

In a possible scenario, where Bitcoin’s price slides into a multi-months (potentially multi-year) bear market, even with an overcollateralization of many x, investor psychology could still become negative and holders could question Strategy’s broader financial health, leading to “irrational” selling pressure.

A potential outcome could be a “high-yield zombie bond”: still technically solvent, paying high yield, but trading at a persistent deep discount because trust and market demand have evaporated. Ultimately, and this is an unwritten law, market sentiment cannot be fully controlled (only a government can do this, and this might become relevant in the case of Strategy. Read the last section about the endgame to find out why).

In the end, the bitcoin price remains Strategy’s Achilles’ heel. We all know that bitcoin is absolutely scarce and should go up in fiat indefinitely. However, we have no 100% certainty as we don’t have this in an uncertain world as ours.

As Bitcoiners, many have called for institutions to adopt bitcoin for the better part of their Bitcoin journey. But now that institutional investors are here, they have started farming volatility. They do so by exploiting tiny price gaps between futures, ETFs, and spot markets through basis and cash-and-carry trades. Their continuous arbitrage and hedging mechanically pull prices back into alignment, turning volatility into a yield source and thereby suppressing realized price swings.

If Bitcoin volatility has indeed entered a secular decline and a severe bear market because of institutionalization, it would signal a troubling development for Strategy. As chainyoda recently called it on X: “Declining volatility is like 9-11 for MSTR”.

While we agree that declining volatility is a consequence of institutionalization, we don’t think BTC’s days of explosive short-term price volatility are over. Bitcoin remains the only global asset with a totally inflexible supply curve, which we think will result in price adjustments to the upside.

The only question from an MSTR perspective is if potentially declining marginal returns will still be enough to power Strategy’s needed growth engine. We would incline to say yes but ultimately don’t know.

What’s the MSTR endgame then?

Notwithstanding any MSTR price predictions, we want to outline MSTR’s endgame as with finish off this piece.

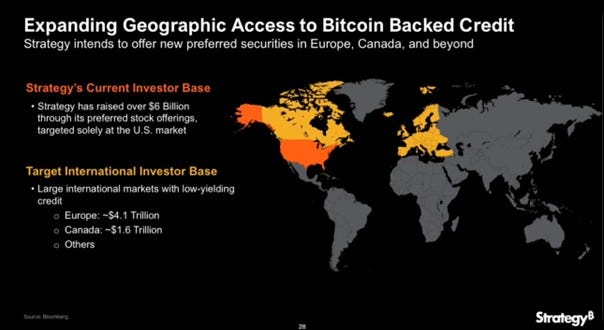

The most relevant slide from Strategy’s earnings call presentation is the one below, where they announced, they are intending to offer new preferreds in Europe, Canda and beyond.

Why is this such a big deal? From the perspective of Strategy as a company, it is a lucrative way to potentially sell its preferreds and thus achieve the aspired amplification they are targeting. There’s a whole lot of boomers all around the world, and in jurisdictions such as Europe or Switzerland, these investors have been even more starved for yield than their counterparts in the United States.

From the viewpoint of the many competing BTCTCs out there, this also means that Strategy plans to eat their lunch.

The most interesting aspect, however, lies in the geopolitical dimension. The United States government has described Bitcoin as a strategic reserve asset, yet it has not been purchasing it in the open market. Instead, it has increased its holdings primarily through confiscations, which is a very different form of accumulation.

Where did the US government seize $15 billion in BTC from?

In October 2025, the U.S. government seized approximately 127,271 Bitcoin, valued at about $15 billion, from the Prince Group, a Cambodia-based criminal organization, one of the largest criminal organizations on earth. It operates the world’s most horrible call centers, where people are supposedly held against their will and forced to defraud people over the internet through romance scams and the like.

Confiscating bitcoin is indeed a very “budget-neutral” way of getting this new strategic asset. But why hasn’t the US government bought yet? Because they don’t have to.

In a “capitalistic society like the US, governments rarely take direct action. Instead, they have “private-market” entities act in a certain way, thereby functioning as the extended arm of government.

Need proof? For example, when the Federal Reserve buys government bonds, they don’t do so directly on the primary market but go through a select set of private primary dealers (banks). The latter buy the government treasuries first and go on to sell to the Fed. Another example is from March 2020, when the Federal Reserve hired BlackRock to manage its debt-buying programs as part of the response to the COVID-19 pandemic.

Now, how does Strategy fit into this? Their plans to IPO their preferreds outside of the US in important strategic step for the United States to get a hold of as many bitcoin as possible. Capital will be raised abroad to on-shore BTC. While all the buyers will get a 10% dividend in devaluing USD, Strategy will buy and hoard the hardest asset on earth.

At some point, enough bitcoin will have been on-shored, and this could very well be the point in time, when the US government nationalizes Strategy, making national MSTR holders whole, while leaving the international ones empty-handed.

What could MSTR nationalization look like in reality?

Back at the Baltic Honeybadger conference in August Willy Woo and Preston Pysh were discussing this exact topic, by gaming out how the US government could actually nationalize Strategy further down the road.

If you know think, we are hallucinating completely, let me tell you: There is precedent for such a scenario in history.

The Bank of England began as a private bank with a clear mandate to finance the British government. In exchange for gold, it paid interest on deposits and attracted large amounts of capital (see the parallel with Strategy?). Over time, through a series of charters and government privileges, competition got stifled, which helps the bank grow in size and importance, and eventually evolve into a central bank.

So, if you really want to understand Strategy’s endgame and how the establishment of the Bank of England is historic precedent for this, we, once again draw your attention to our book ‘The Bitcoin Enlightenment’, which has an entire chapter on this.

Latest Podcast Episode

written by Pascal Hügli

This was a true masterclass on how to think about valuation of digital assets. We talk about how Bitcoin is different from everything else and how to think about it. We also talk about layer-1s and how to think about their fundamental value.

With Bob from Lighthouse Macro I talked about the recent repo stress, how the buyer profile for the US Treasury market is evolving and why Bitcoin is systemic for US policy makers! Very insightful episode!

The consols comparison is brilliant because it highlights how Bitcoin as collateral fundamentally changes credit markets the same way the gold standard did. Your scenario analysis showing 30% amplification as the sweet spot is really practical advice, especially with the preferreds offering stable yield while common equity captures all upside. The nationalization endgame you outlined isn't far fetched when you look at how governments use private entities as extended arms, and IPOing preferrds internationally to onshore BTC fits that pattern perfectly.

See what happens I guess.