Bitcoin: A waiting game with upside

Are tariffs inflationary? And is liquidity rising? When Altcoin Season? Bitcoin-collateralized loans, sound money investor, stablecoin boost for tradfi stock

Thank you for sharing our newsletter with your colleagues and friends💪🏻🙏🏻

Let's gooo 🎢 What you can expect today:

Knowledge level : 🟢 Beginner | 🟡 Advanced | 🔵 Expert

Insight DeFi auf Social Media: LinkedIn / Instagram / Twitter / YouTube / Telegram

This newsletter is powered by Newhedge—your go-to platform for advanced Bitcoin analytics and market intelligence. With 200+ proprietary indicators, live derivatives data, and real-time on-chain metrics, Newhedge offers the precision serious traders need. Backed by top Bitcoin investors, it bridges traditional finance with Bitcoin’s evolving landscape. Get your edge today—sign up free at newhedge.io and enjoy 50% off your advanced subscription with the code SIGNAL.

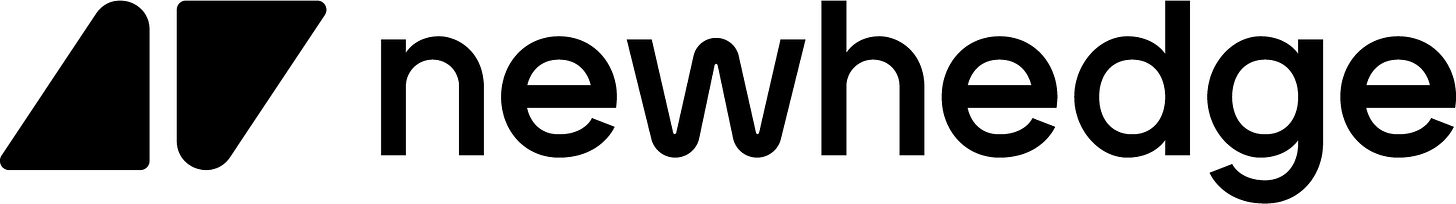

Sneak peek indicator: Bitcoin Price Performance Since Halving

🟢 Everything at a glance

written by Pascal Hügli

🌐 Total Crypto Market Cap: $3.22 trillion

🌊 Digital Asset Fund Flows: -$415 million

💰 Bitcoin Price: $96,621

🚀Ether Price: $2,680

💪Bitcoin Dominance: 61.02%

🏦Total Value Locked in DeFi: $112 billion

💳Total Stablecoin Market Cap: $234 billion

😨🤑 Krypto Fear and Greed Index:

🟡 Podcast-Episode “Less Noise More Signal”

written by Pascal Hügli

We have a bunch of new podcast episodes to share with you.

In our episode with finance professor Nik Bhatia, we took a deep dive on how the monetary system really works. What are the different forms of money? Who is actually creating money? What is the role of U.S. Treasury debt and do central banks really create inflation? This one is geeky, but if you are a monetary system nerd, you will love it!

In our episode with Bitcoin programmer Shehzan Maredia, we talk about the famous Coinbase loan product, where people can deposit wrapped Bitcoin and get a loan against it. We then compare it to Lava, a very elegant solution that is Bitcoin-native and is evolving into the gold standard among Bitcoin-collateralized loan products. This one is for all the practitioners out there that want to put their Bitcoin at work!

In our latest episode with sound money investor Lawrence Lepard, we talk about gold, why he thinks Bitcoin will outperform gold, why inflation is making us poorer, whether the fiat system will indeed end one day and how he is preparing for his retirement age as a baby boomer in his 70s. This was quite a fun discussion between a boomer and a millennial! Check it out.

Enjoy. And please leave a like (and comment) on any of the videos. This really helps the show to grow!

🟡Market Update: Our regular overview give us now🙏

written by Pascal Hügli

Tariffs war? Deepseek AI fiasco? Higher for longer rates? The direction of global liquidity? Ever stronger dollar? Will a strategic bitcoin reserve (SBR) become a reality or not?

A lot to take in! While equities and gold managed to climb to new ATHs, being the most sensitive macro asset out there, Bitcoin reacted with mixed feelings.

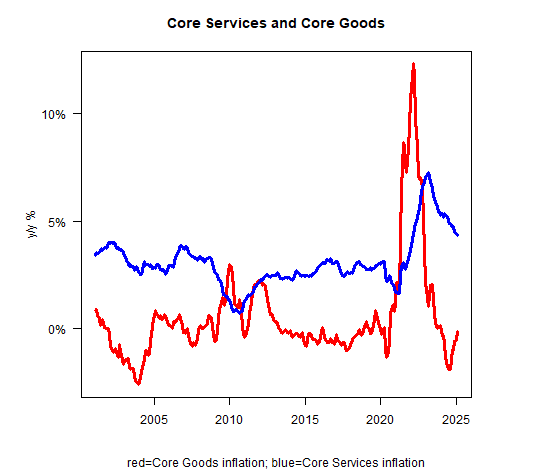

What spooked financial markets were the latest inflation numbers. The CPI reading came in at 3% (consensus was 2.9%). January was up .5%, the hottest monthly reading since June of ‘22. And PPI came in at 3.5% (3.3% expected). This was the highest reading since Feb. 2023. Core services continue to come down, but we saw an uptick in goods.

The market has begun to price out rate cuts, now expecting fewer cuts from the Fed in 2025, with only 1.5 cuts priced in over the next 12 months.

The Fed has also shifted its stance to neutral for two key reasons:

Potential inflation risks stemming from new tariffs

Low credit spreads and continued resilient economic growth

Additionally, as services remain the largest component of U.S. GDP and service-sector inflation continues to trend downward, the Fed has been able to pause its tightening cycle for now—without needing to immediately pivot back to rate hikes.

So then, what’s happening with inflation if we zoom in?

Are tariffs inflationary?

The main revelation was that services inflation is easing while goods inflation is showing signs of increase. The latter’s increase is offsetting some of the inflation progress, making it challenging to bring overall inflation down to the Federal Reserve's 2% target.

The challenge with goods inflation lies in its vulnerability to potential tariffs, as the majority of U.S. imports fall under the goods category.

While the exact impact of tariffs on inflation remains uncertain, there’s a case to be made that higher prices for imported components could drive up costs for domestic industries. This would likely put upward pressure on the Producer Price Index (PPI), eventually feeding into the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE).

Although this is the risk, Stephen Mira, the chair to Trump's Council of Economic Advisers (CEA), has argued in a recent paper that tariffs mustn’t be inflationary at all. Here’s what he wrote:

“Many argue that tariffs are highly inflationary and can cause significant economic and market volatility, but that need not be the case. Indeed, the 2018-2019 tariffs, a material increase in effective rates, passed with little discernible macroeconomic consequence. The dollar rose by almost the same amount as the effective tariff rate, nullifying much of the macroeconomic impact but resulting in significant revenue. Because Chinese consumers’ purchasing power declined with their weakening currency, China effectively paid for the tariff revenue.

While in principle tariffs can be noninflationary, how likely is it? In the macroeconomic data from the 2018-2019 experience, the tariffs operated pretty much as described above. The effective tariff rate on Chinese imports increased by 17.9 percentage points from the start of the trade war in 2018 to the maximum tariff rate in 2019 (see Brown, 2023). As the financial markets digested the news, the Chinese renminbi depreciated against the dollar over this period by 13.7%, so that the after-tariff USD import price rose by 4.1%. In other words, the currency move offset more than three-fourths of the tariff, explaining the negligible upward pressure on inflation. Measured from currency peak to trough (who knows exactly when the market begins to price in news?), the move in the currency was 15%, suggesting even more offset.”

Key question: How interest rate sensitive is today’s economy?

We want to come back to where we think inflation is headed next. But first, we want to point out why the Fed’s high policy rates (short-term interest rates = Fed funds rate) seem to have been rather ineffective in bringing down growth (and thus inflation to the 2% target) in the wider economy.

With the CPI at 3% and the Fed Funds rate at 4.33%, there’s still a gap of over 100 basis points. One could argue that monetary policy remains restrictive, though less so than in the summer of last year, when the policy rate hovered around 5% or slightly higher.

Some argue that the economy has now become more sensitive to interest rates than it was during the time period of 2022 to 2023. They point to construction spending in the US that has come down significantly as well as manufacturing construction that is also trending down with considerable momentum.

While this is the case, the labor market, which is doing better lately, and personal consumption are not affected by the higher policy rates.

Some argue that the traditional transmission mechanism of high policy rates has become muted in today’s environment for two main reasons:

Shift to a services-driven economy: The current industry mix is increasingly dominated by services, which are generally less sensitive to interest rate fluctuations compared to goods-producing sectors.

Stronger private sector balance sheets: The private sector now holds more U.S. Treasuries, meaning higher policy rates generate more treasury income for businesses and households. This additional income has a stimulative effect, offsetting the burden of higher interest expenses within the private sector.

This ultimately means that the Fed’s actions may be less effective at curbing inflation than experts and technocrats anticipate, as their impact on the economy and growth appears to be less pronounced than traditionally assumed.

Where does inflation go after all?

Analyzing data from Truflation and its dashboard suggests that inflation is likely to decline in the coming months.

Truflation is regarded as a leading indicator, typically showing inflation trends with a three-month lead compared to official U.S. government-reported figures, such as the CPI (we will have Stefan Rust, the founder of Truflation on our podcast soon to figure out why this is so).

So our view is that we are not particularly concerned with sticky inflation. For one, crude oil has remained quite stable in its $60-$80 range for nearly 2.5 years. We do expect this trend with crude oil to continue under Trump’s pro-deregulation policies (remember, he’s all about “drill baby drill”).

At the same time, there are no major supply shocks on the horizon (think COVID lockdown), while AI-driven productivity improvement and efficiencies are creating deflationary pressures.

Coming back to tariffs,we do believe that any tariffs imposed by Trump are likely to cause only a one-time inflation bump on select goods, with fears of broader inflation seen as overblown.

Is liquidity improving?

So inflation is not coming back but then also, growth is resilient, we do believe that the Fed will stick to its pause for the time being. This doesn’t mean though, that overall financial liquidity cannot improve, positively impacting risk assets like stocks or digital assets.

Some of what we discussed in this podcast or our last article is already coming to fruition. As is the case, the TGA is about to be run down. This will push U.S. liquidity into a meaningful uptrend, as government spending transfers money from the Treasury General Account (TGA) into bank reserves. When the government pays its bills, recipients—whether individuals, businesses, or agencies—deposit the funds into their bank accounts, boosting reserves in the financial system.

As a result, QT may finally be paused. As a matter of fact, a TGA drawdown increases bank reserves initially, easing potential reserve scarcity—something the Fed is keen to avoid. However, once the TGA is depleted and needs replenishing, reserves could be drained back out, potentially tightening liquidity again, even to the point where a potential scarcity could manifest itself.

Aware of this risk, the Fed has signaled in its latest minutes that it stands ready to intervene if needed.

“Regarding the potential for significant swings in reserves over coming months related to debt ceiling dynamics, various participants noted that it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of this event.”

Two more liquidity-positive developments have to be quickly mentioned:

Firstly, new Treasury Secretary Bessent just stated publicly that the U.S. is still far from restructuring the term structure of its debt. In other words, the Treasury will continue to focus on issuing short-term bills, a strategy that Bessent's predecessor, Yellen, followed for the past few years.

As we’ve discussed in this podcast, short-term bill issuance tends to be more stimulative for the economy and thus liquidity-positive.

Secondly, global liquidity is poised for a modest uptrend, which could be further accelerated by a potential weakening of the U.S. dollar—especially if early signals from Trump's first presidency are any indication.

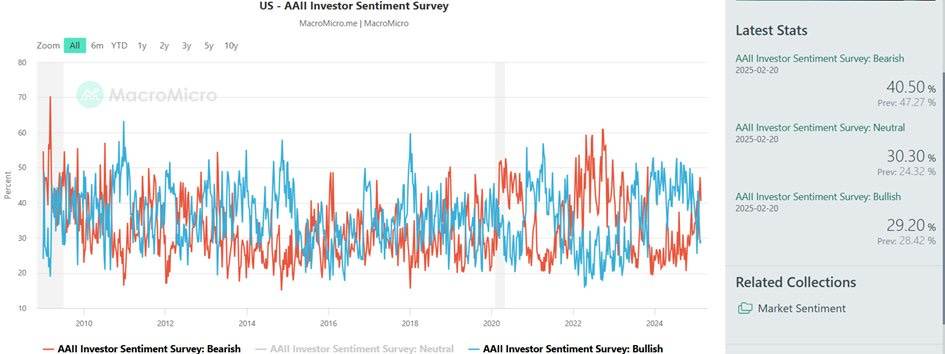

If liquidity indeed is rising over the coming weeks to months, retail investors may be caught off guard, as they currently appear to be positioned on the wrong side of the trade. How do we know this?

Well, the AAII investor sentiment survey (see graph below) shows a significant gap between bullish and bearish investors, indicating that retail investors are underexposed to risk assets.

What does this mean for digital asset?

Despite several unknowns—primarily stemming from the new U.S. administration—the market environment for digital assets remains overall positive.

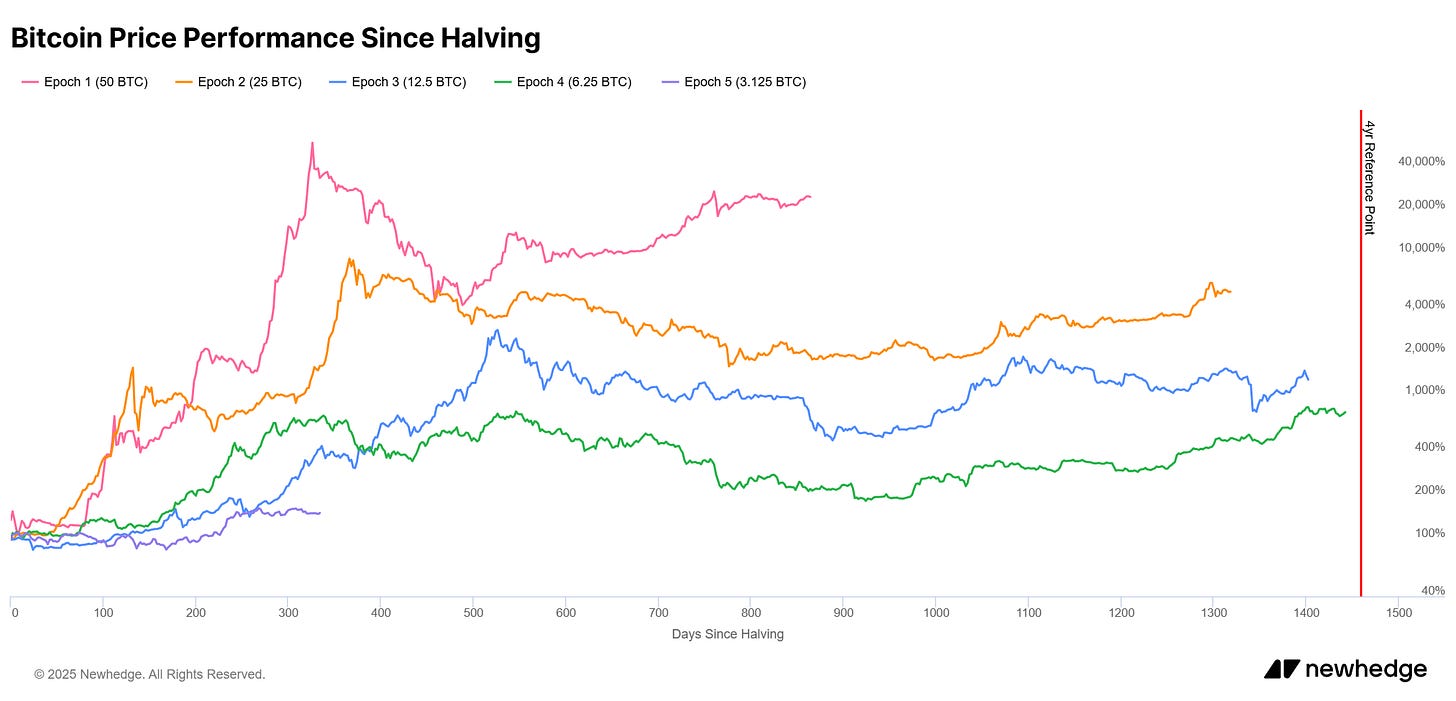

Bitcoin is likely to stay stable and continue its upward trajectory, potentially reaching the 108k range high. It’s notable how well Bitcoin has absorbed sustained selling pressure in recent weeks, signaling a strong and resilient demand.

This solid foundation should also provide support for altcoins, although there are no clear signs of a near-term rally for them.

Conclusion

Here’s what we think you should take away from this macro update:

Fed to pause interest rate hikes for the foreseeable future

Perceived inflation risks are unlikely to materialize into significant impact

Tariffs may cause a one-time inflation shock, but not sustained pressure

Reported inflation data likely to improve in the coming months

However, economic growth remains resilient due to lower interest rate sensitivity in today's economy

Liquidity expected to rise in the coming weeks to months

Bitcoin is looking robust, but no altcoin season in sight

🟢 This Stock Will Cash in on Stablecoin Adoption

written by Pascal Hügli

We In our last piece, we were mentioning that stablecoin adoption is up only from here. Given the new US administration, it is very likely that very favorable regulatory changes will come for stablecoins:

In fact, there is already a stablecoin bill on the table—the Lummis-Gillibrand Payment Stablecoin Act—which has a strong chance of being passed into law in 2025. With bipartisan support in Congress and a Trump administration keen on promoting financial innovation, it seems very likely that a comprehensive stablecoin bill will pass. If this happens, the market capitalization of stablecoins is poised to grow rapidly, as the lines between centralized crypto exchanges, global payment platforms, and traditional fintech companies blur, with many of these players merging into next-generation consumer super apps.

It is true that many traditional companies in the financial services, payment processing, technology, and e-commerce sectors are poised to profit significantly from the rise of stablecoins. Payment processors can benefit from the adoption of stablecoins by incorporating them into their networks, facilitating faster and cheaper transactions.

Tech companies that offer digital payment solutions can tap into the growing use of stablecoins for seamless transactions, while e-commerce giants may leverage them for faster and lower-cost international payments.

Below, we highlight a specific stock poised to benefit significantly from the growing adoption of stablecoins.

This opportunity stands out because public equity markets have yet to fully recognize the transformative potential of stablecoins. As a result, the advantages they offer aren’t priced into the current valuation, creating a unique upside opportunity with limited downside risk if the thesis doesn’t play out as expected.

Without further ado, this is the stock we are talking about….